Get up to $200 in Bitcoin

Get up to $200 in Bitcoin

Featured in:

How to Claim Your Bonus

Follow these steps to secure your Bitcoin bonus.

Create an SMSF Account

Sign up and open your SMSF account before 31 July 2025. Once your account is verified, you’ll receive $100 in Bitcoin.

Deposit Funds

Make deposits of $10,000 or more into your SMSF account by 31 July 2025 to receive an extra $100 in Bitcoin.

Start Investing

Start investing with access to Bitcoin and over 1,000 digital assets on Coinstash.

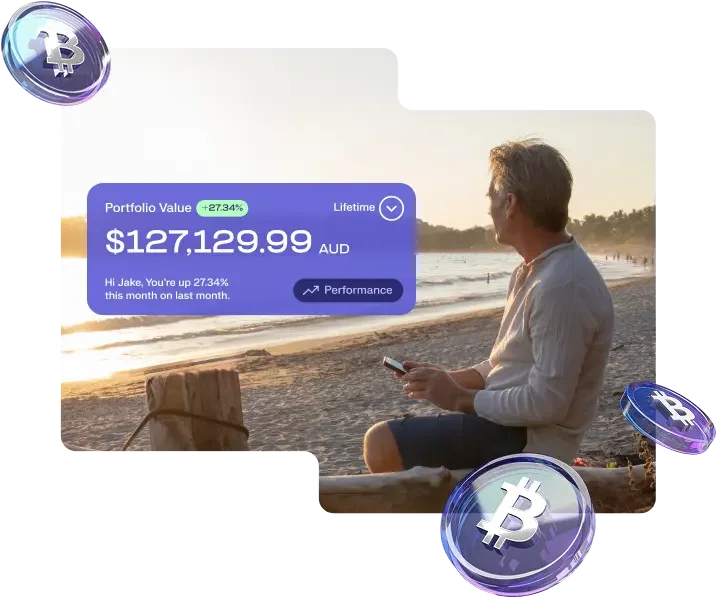

Why Coinstash for Your Crypto SMSF

Why Coinstash for Your Crypto SMSF

Australia’s Largest Range of Coins

Portfolio Tracking

SMSF-Friendly EOFY Reports

Same-Day Onboarding

Frequently Asked Questions

Why set up an SMSF account with Coinstash?

Coinstash is one of Australia’s leading Self-Managed Super Fund crypto trading platforms, helping SMSFs invest in cryptocurrencies since 2017. Our in-house SMSF specialists provide one-on-one account onboarding and ongoing account management support. With Australia’s largest range of crypto assets and a suite of powerful trading and investing tools, Coinstash has everything you need to manage your SMSF crypto investments with confidence.

How do I set up a SMSF account with Coinstash?

Setting up a Self-Managed Super Fund account with Coinstash is simple. You can either create your account and upload the required documents yourself or book a one-on-one consultation with our SMSF specialists for personalised guidance.

How long does it take to set up a SMSF account?

We offer same-day SMSF account setup with personalised, one-on-one onboarding consultations, so you can start investing without delay.

What documents are needed to set up a SMSF account?

To create your Self-Managed Super Fund account, you'll need to provide at least the following documents: SMSF name; SMSF trust deed document; SMSF ABN; SMSF trustee information, including ACN and director/beneficial owner information if a corporate trustee; and Standard personal verification documents.

Can I use my personal Coinstash account for my SMSF?

No, you cannot use your individual Coinstash account for your Self-Managed Super Fund. Australian SMSF regulations require that SMSF assets are kept completely separate from personal assets. To ensure compliance, you’ll need to set up a dedicated SMSF account on Coinstash.

Can SMSFs invest in crypto?

Investing in cryptocurrencies such as Bitcoin and other digital assets through an SMSF is legal, provided that certain criteria are met. For example, cryptocurrencies investments must be allowed in the trust deed, be in accordance with the funds investment strategy, and adhere to the same regulatory requirements as other investments as specified in the superannuation and tax laws. We recommend consulting a registered financial professional before starting your SMSF crypto investment journey.

What laws apply to SMSFs?

Self-Managed Super Funds need to comply with the Superannuation Industry (Supervision) Act 1993 (Cth) (SIS Act) and Superannuation Industry (Supervision) Regulations 1994 (Cth) (SIS Regulations) as well as various other laws that may be applicable. Trustees are responsible for staying informed about any legal and regulatory changes and ensuring the fund remains compliant with all regulations.

What is the Sole Purpose Test?

The Sole Purpose Test requires that all Self-Managed Super Funds in Australia are used exclusively to provide retirement or death benefits for fund members. Investment decisions must benefit the fund directly, and no one—including trustees—can gain personal financial benefits from the fund’s money. This is a key legislative requirement for SMSFs, ensuring that funds are used solely for their intended purpose.

Are there risks investing in crypto with my SMSF?

Self-Managed Super Funds are highly regulated in Australia. We recommend that you consult with a registered financial professional for individual advice before you begin your SMSF journey with us. Please also check the Australian Taxation Office and Business.gov websites for the latest information on SMSFs. For risks associated with trading crypto on Coinstash’s platform, please refer to our Risk Disclosure Statement.

How much do I deposit to qualify for the $100 BTC deposit bonus?

To qualify for the $100 Bitcoin deposit bonus, you must deposit a net amount of $10,000 or more into your account by 31 July 2025. Withdrawals made during the promotion period will reduce your net deposit total. For example, if you deposit $30,000 but withdraw $10,000, your net deposit will be $20,000, and you’ll still qualify for the bonus.

When are the bonuses paid?

Only new SMSF accounts are eligible for this promotion. The signup bonus of $100 in BTC will be awarded once you successfully verify your SMSF account. The deposit bonus of $100 in BTC will be awarded on 7 August 2025 to all qualifying accounts.