SMSF Accounts

Making crypto super simple.

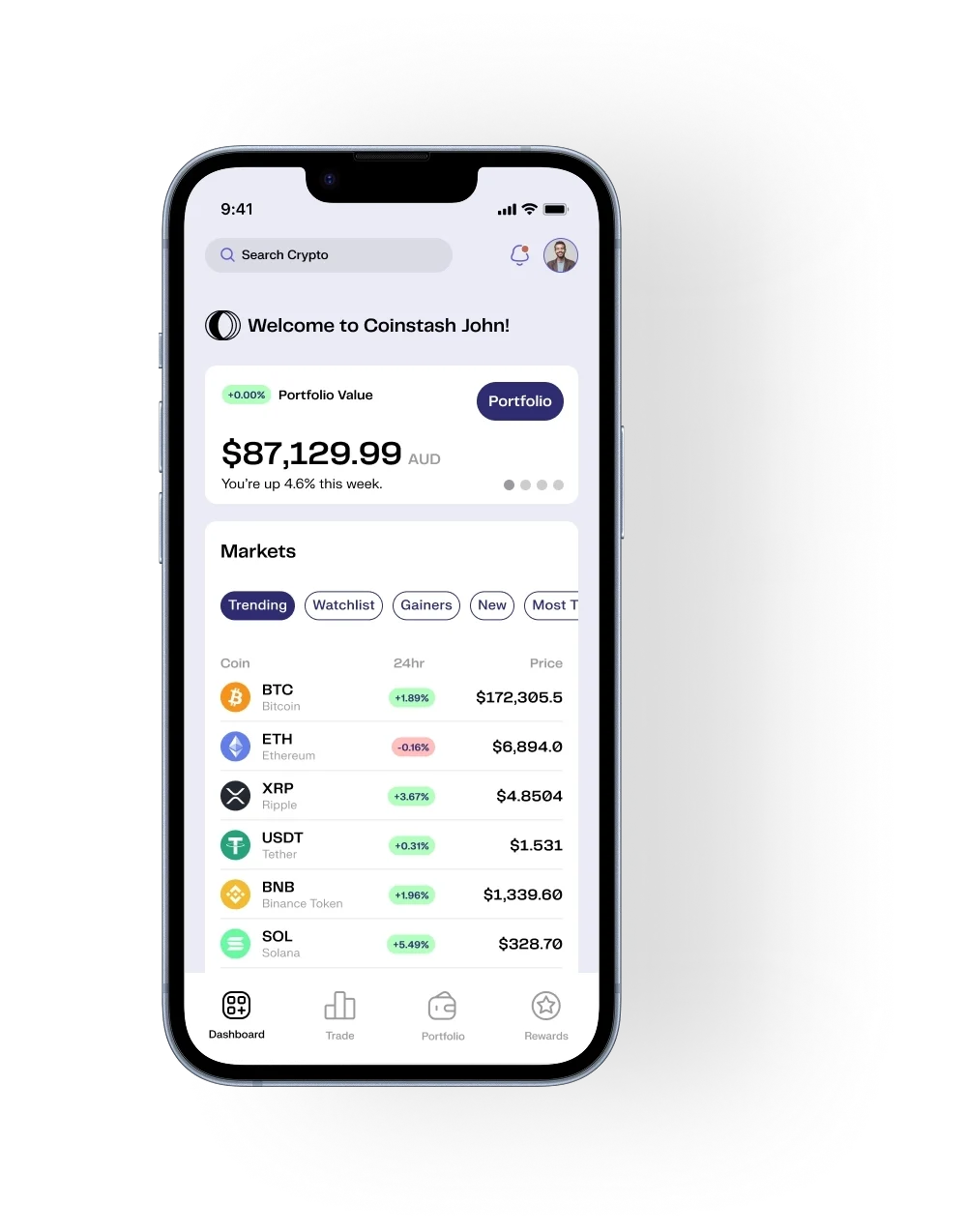

Join thousands of Australians investing in crypto through their SMSF on Coinstash.

Australia’s Leading Crypto SMSF Investment platform

Partners & Affiliations

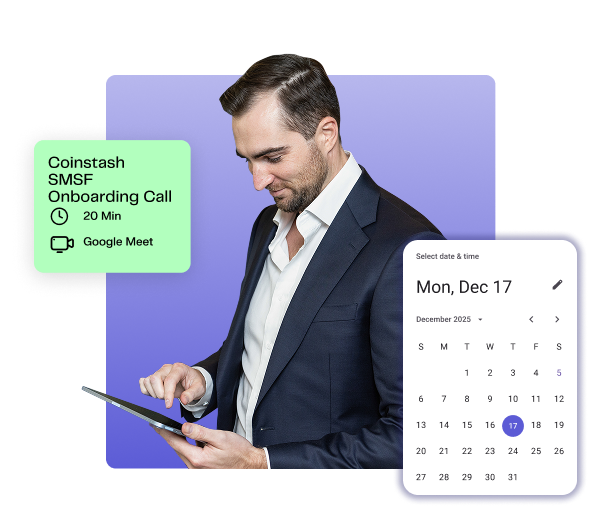

SAME-DAY onboarding

Start investing in crypto with your SMSF sooner with our priority same-day onboarding service.

dedicated account management

Receive expert guidance from our SMSF Account Management team, supporting you from onboarding through every stage of your investment journey.

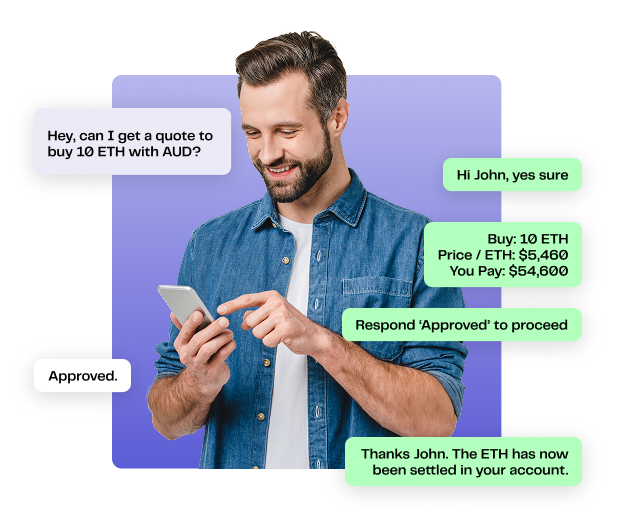

OTC Desk Access

Access our specialised OTC trading desk to secure zero slippage and better pricing on large trades.

AUSTRALIAN OWNED & OPERATED

$2B+

Volume Traded

50,000+

Users

1,000+

Cryptocurrencies

Best-in-class tax reporting

Easily manage your EOFY tax and audit obligations with our specialised SMSF tax reporting tools.

Detailed EOFY Reports

Receive comprehensive transaction reporting to help your SMSF stay compliant.

Tax-App Integrations

Seamlessly connect and sync your transactions statements with third-party crypto tax apps.

Adviser Portal

Give trusted third parties - like your accountant or financial adviser - secure, tiered access to your account via our Adviser Portal.

Hear From Our SMSF Clients

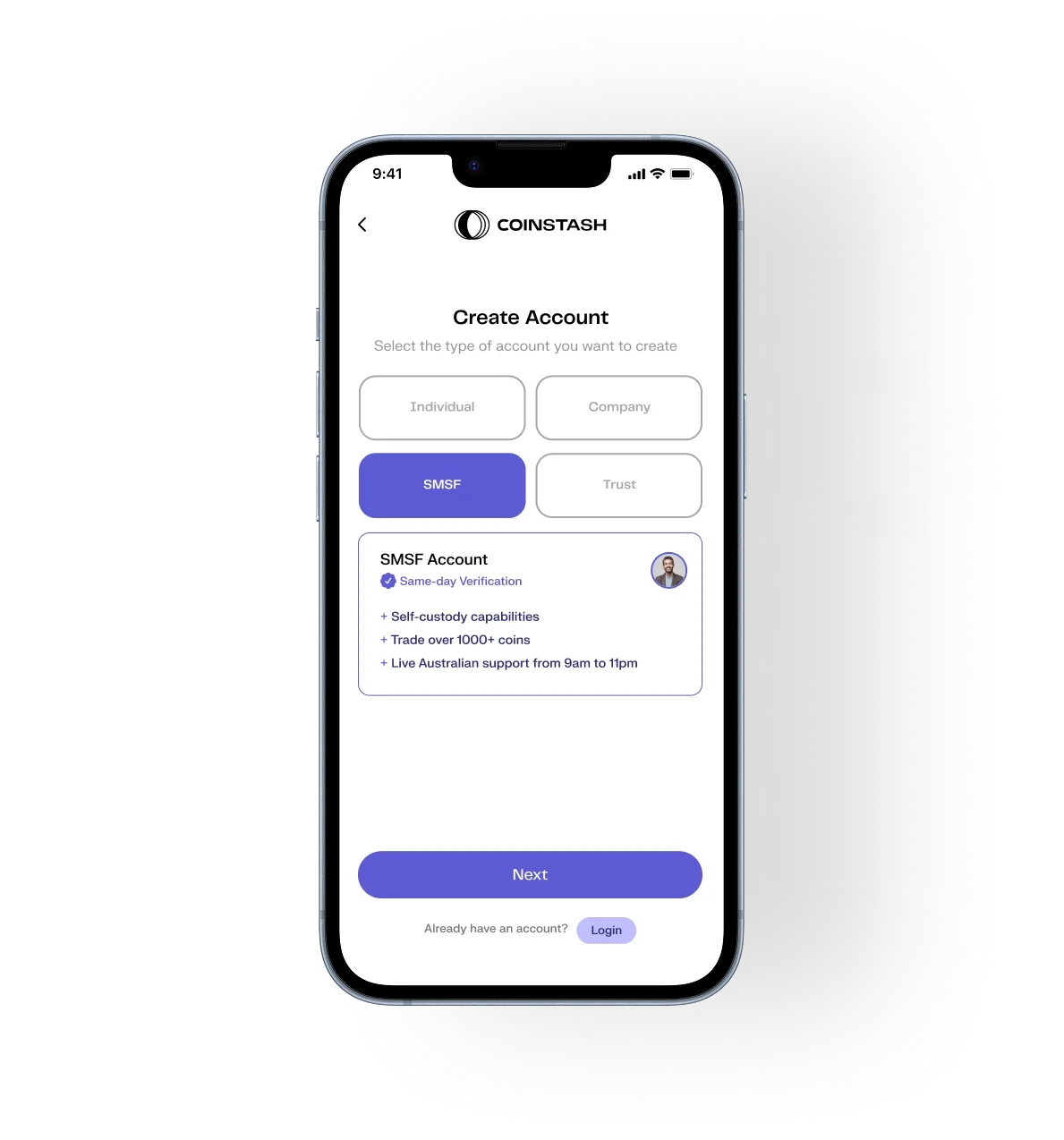

How to Set Up your Crypto SMSF Account

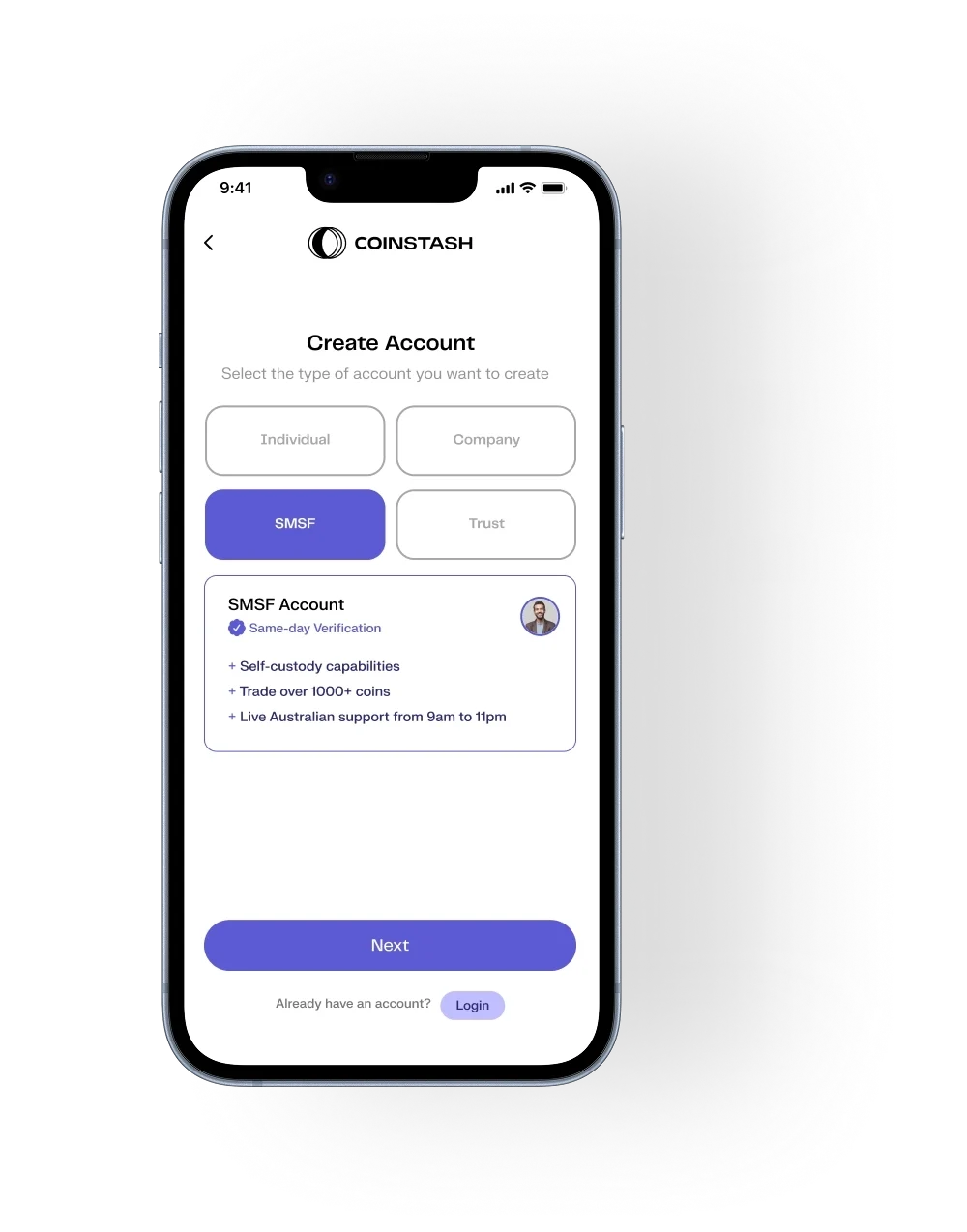

Create SMSF Account

Sign up as an SMSF account, or book a consult with one of our experts for personalised onboarding assistance.

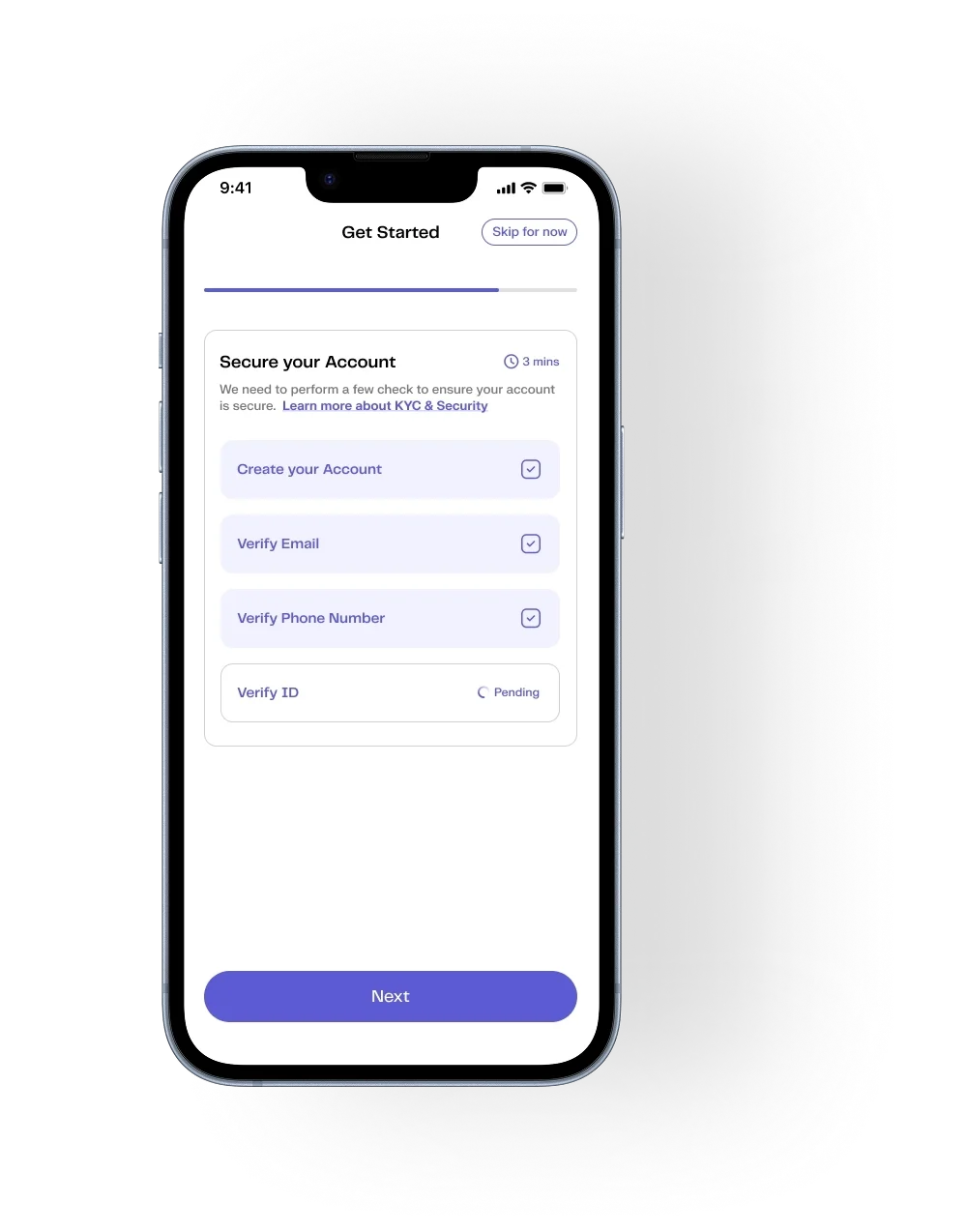

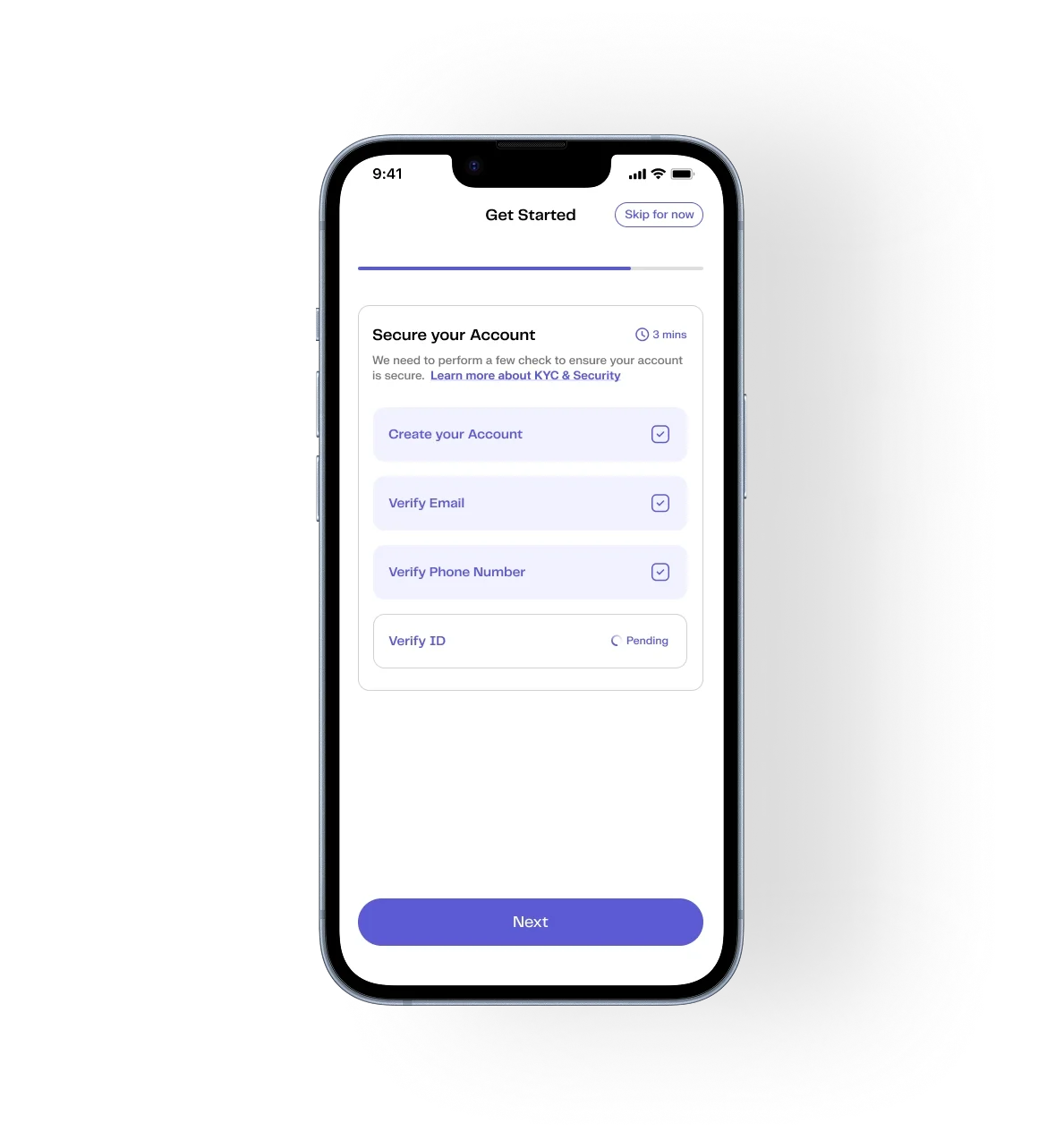

Submit Personal Information

Complete identity verification and provide the relevant SMSF documentation when prompted.

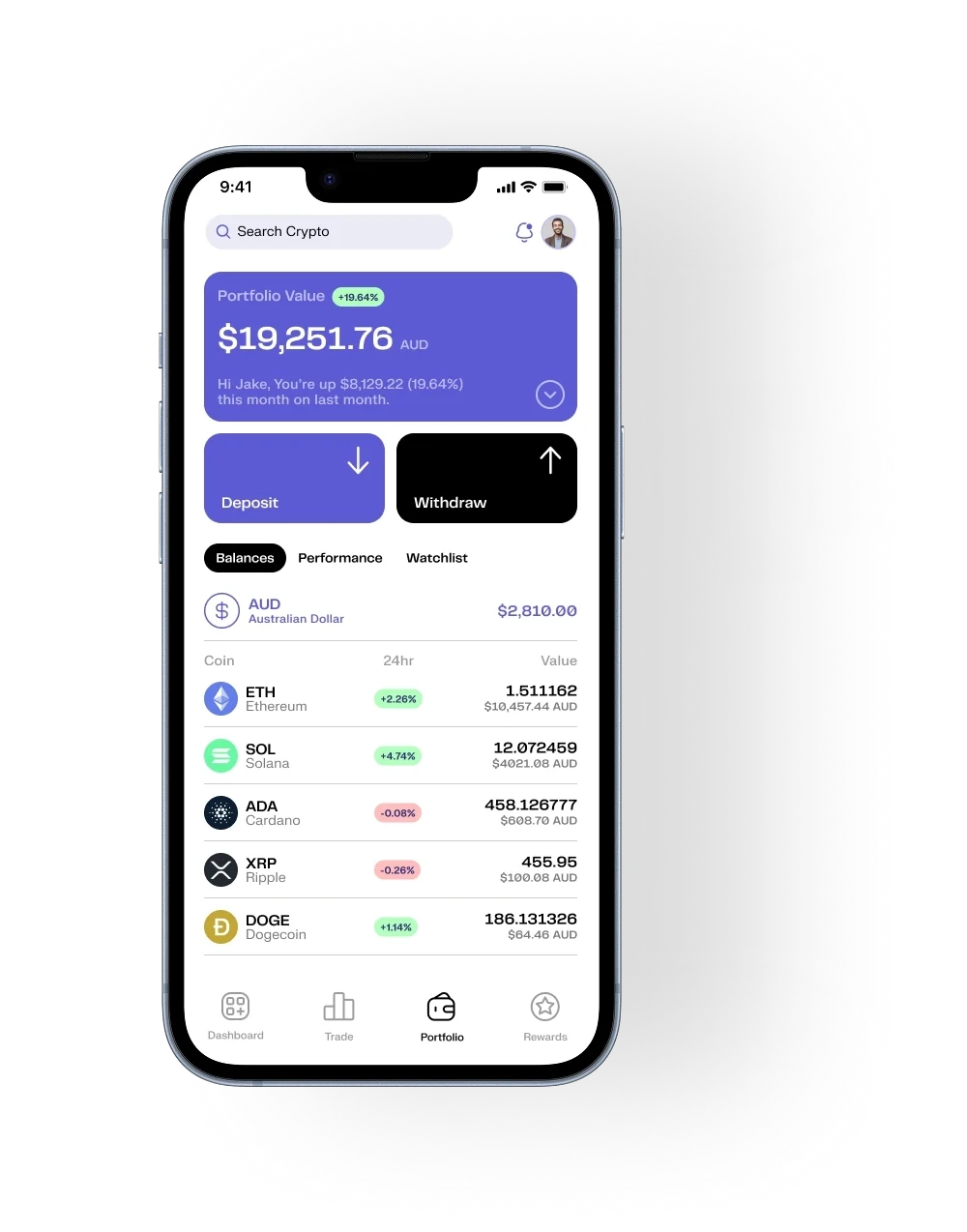

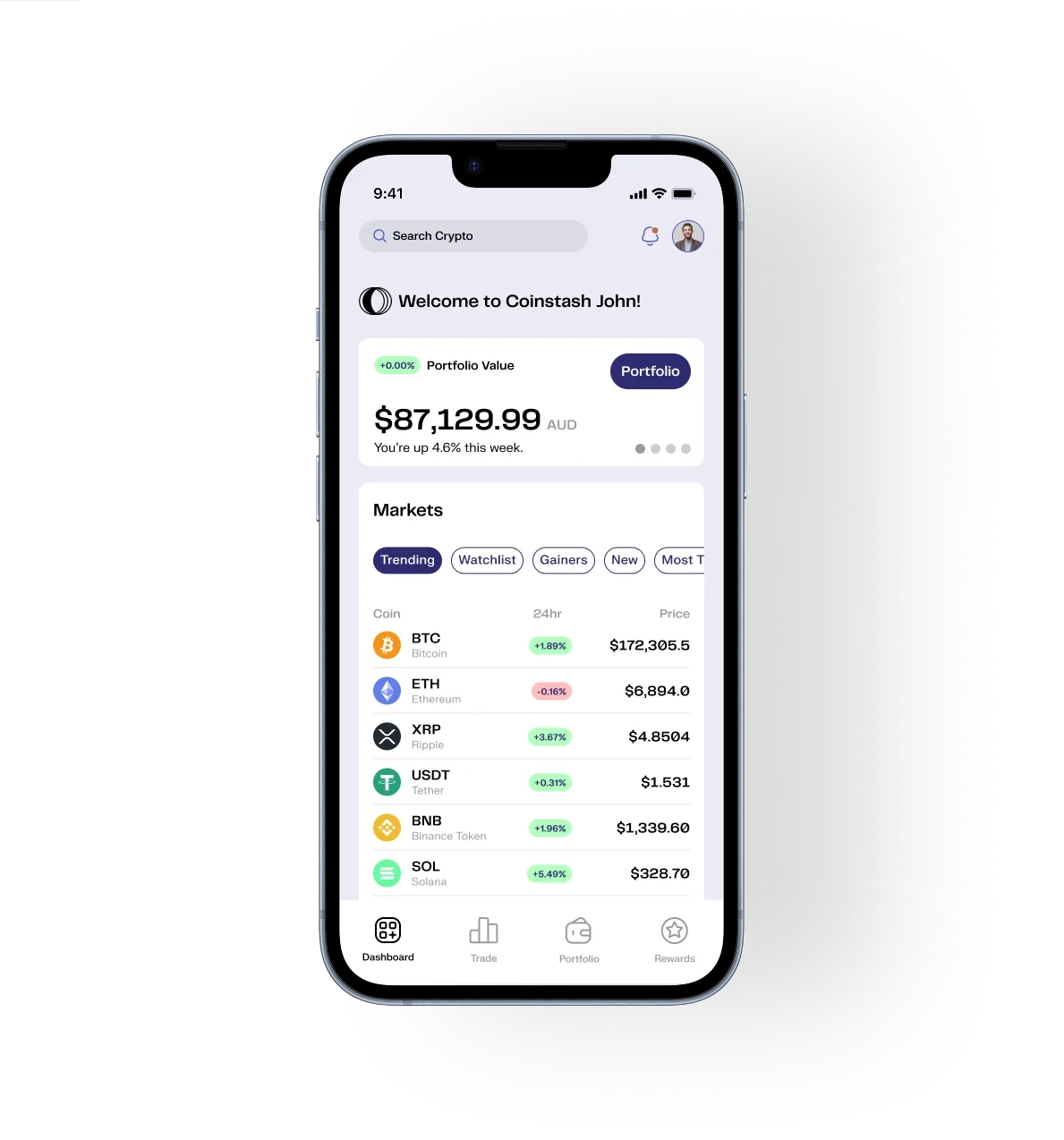

Start Investing

Once your account is approved, you can begin building your crypto SMSF portfolio.

How to Set Up your Crypto SMSF Account

Create SMSF Account

Sign up as an SMSF account, or book a consult with one of our experts for personalised onboarding assistance.

Submit Personal Information

Complete identity verification and provide the relevant SMSF documentation when prompted.

Start Investing

Once your account is approved, you can begin building your crypto SMSF portfolio.

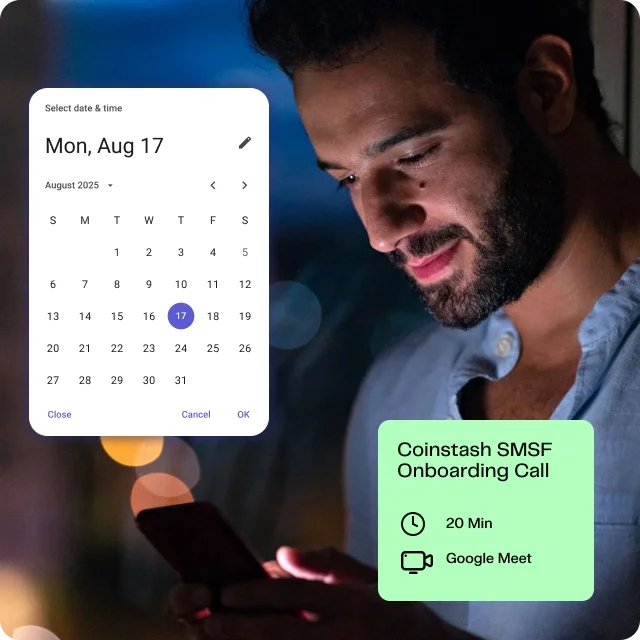

Don’t have an existing smsf?

Schedule a call with one of our SMSF specialists and we’ll connect you with one of our trusted licensed partners to set up your crypto SMSF.*

*Coinstash is not a licensed financial advisor. We recommend you consult with a licensed financial advisor on whether a SMSF is suitable for your personal circumstances.

Start Building Your SMSF Portfolio

Join thousands of SMSF investors gaining exposure to the world’s fastest growing asset class.

Frequently Asked Questions

Have more questions? Speak with our friendly support team.

Why set up an SMSF account with Coinstash?

Coinstash has been helping Australians invest in crypto through their SMSFs since 2017. Our platform is purpose-built for SMSF investors, delivering a comprehensive end-to-end investing experience.

We provide one-on-one onboarding to help you set up your SMSF crypto account, along with dedicated account management support to guide you every step of the way. You’ll also gain access to Australia’s largest selection of cryptocurrencies and a powerful suite of trading tools to manage your investments with ease, while our tax integrations and reporting features help keep your SMSF compliant so you can invest with confidence.

How do I set up an SMSF account with Coinstash?

Setting up a crypto SMSF account with Coinstash is simple. You can either create your account and upload the required documents yourself or book a one-on-one consultation with our SMSF specialists for personalised guidance.

How long does it take to set up an SMSF account?

We offer same-day crypto SMSF account setup with personalised, one-on-one onboarding consultations, so you can start investing in crypto without delay.

What documents are needed to set up an SMSF account?

To create your crypto SMSF account, you'll need to provide at least the following information and documents: SMSF name; SMSF trust deed document; SMSF ABN; SMSF trustee information, including ACN and director/beneficial owner information if a corporate trustee; and standard personal verification documents.

Can I use my personal Coinstash account for my SMSF?

No, you cannot use your individual Coinstash account for your Self-Managed Super Fund. Australian SMSF regulations require that SMSF assets are kept completely separate from personal assets. To ensure compliance, you’ll need to set up a dedicated SMSF account on Coinstash.

Can SMSFs invest in crypto?

Investing in cryptocurrencies such as Bitcoin and other digital assets through an SMSF is legal, provided that certain criteria are met. For example, cryptocurrencies investments must be allowed in the trust deed, be in accordance with the funds investment strategy, and adhere to the same regulatory requirements as other investments as specified in the superannuation and tax laws. We recommend consulting a registered financial professional before starting your SMSF crypto investment journey.

What laws apply to SMSFs?

Self-Managed Super Funds need to comply with the Superannuation Industry (Supervision) Act 1993 (Cth) (SIS Act) and Superannuation Industry (Supervision) Regulations 1994 (Cth) (SIS Regulations) as well as various other laws that may be applicable. Trustees are responsible for staying informed about any legal and regulatory changes and ensuring the fund remains compliant with all regulations.

What is the Sole Purpose Test?

The Sole Purpose Test requires that all Self-Managed Super Funds in Australia are used exclusively to provide retirement or death benefits for fund members. Investment decisions must benefit the fund directly, and no one—including trustees—can gain personal financial benefits from the fund’s money. This is a key legislative requirement for SMSFs, ensuring that funds are used solely for their intended purpose.

Are there risks investing in crypto with my SMSF?

Self-Managed Super Funds are highly regulated in Australia. We recommend that you consult with a licensed financial professional for tailored personal advice before you begin your SMSF crypto journey with us. Please also check the Australian Taxation Office and Business.gov websites for the latest information on SMSFs. For risks associated with trading crypto on Coinstash’s platform, please refer to our Risk Disclosure Statement.

Can I keep my crypto SMSF holdings in cold storage?

Yes, you can hold your SMSF’s crypto assets in cold storage, provided it meets the ATO’s requirements for SMSF asset ownership and security. The wallet must be owned and controlled by the SMSF, not by individual members or trustees personally. You should ensure:

- The wallet is set up in the name of the SMSF.

- The private keys are securely stored and controlled according to the fund’s investment strategy.

- Proper records and audit trails are maintained to show that the assets belong to the SMSF.

Always seek independent professional advice to make sure your storage method complies with SMSF rules and your fund’s investment strategy.