DYDX vs Uniswap: The Battle For Fees & Token Value Accrual

Key Takeaways

- DeFi’s most prominent platforms, dYdX and Uniswap, took two divergent paths to drive token value accrual.

- The Uniswap DAO has resisted community pressure to turn on the fee switch, whereas dYdX Chain distributes all fee revenue to validators and stakers.

- Uniswap Labs’ protocol fee switch and dYdX total fees paid show the potential for serious revenue, especially in bull markets.

- It will be crucial to monitor their performance, as it may influence how the rest of the DeFi sector approaches distributing protocol revenue.

- The biggest blocker remains regulatory uncertainty. If it comes, will Uniswap finally assign more productive power to UNI?

dYdX vs Uniswap: Why This Deserves Your Attention

The last month was defined by two polarising DeFi platforms, dYdX and Uniswap, taking vastly different approaches to how their native tokens accrue value.

dYdX is the largest decentralised derivatives exchange, with roughly 50% market share. All fees go to dYdX Chain validators and stakers (i.e. DYDX holders that stake to dYdX Chain validators).

Uniswap is the largest DEX with over 65% market share. All of the protocol fees go to liquidity providers (LPs). Additionally, Uniswap Labs, a privately owned entity based in the U.S., charges 0.15% on certain swaps on their apps.

Given that dYdX and Uniswap are arguably the two most widely used DeFi protocols, it will be crucial in 2024 to monitor their performance, as it may influence how the rest of the DeFi sector approaches token value accrual.

Definitions

I’ll be using Token Terminals’ definition of ‘protocol revenue’—the fees kept by the protocol and/or distributed to token holders.

You may also see this called the ‘fee switch’. Overall, there are two main ways the protocol can distribute revenue and its native token:

- Activating a ‘fee switch’ for using the protocol, which is sent to the protocol’s treasury

- For example—Lido captures a 5% fee on staking rewards; however, LIDO or LIDO holders do not directly receive these fees.

- Allowing token holders to stake the token to get a share of protocol fees

- For example—GMX has a “fee switch”, and stakers can earn 30% of the protocol fees.

Uniswap Approach: No Fee Switch (Yet)

It’s no secret that Uniswap’s native token, UNI, has been struggling. It’s 86% below its 2021 highs, mainly due to its lack of utility and value accrual.

It is currently used for broad “governance” purposes. Still, for years, the community have hoped the “fee switch” will be turned on—allowing the Uniswap protocol to capture revenue for its usage.

There has been a controversial push for the Uniswap protocol to turn on the fee switch. So far, no trials have taken place.

But in October, this pressure on Uniswap and UNI only grew, with Uniswap Labs turning on the fee switch, but not the type most expected. Uniswap Labs introduced a fee on their official Uniswap front-ends, with a small 0.15% fee on over 11 different reading pairs.

The result was impressive, with over $1.5M in revenue since the fees were introduced on Oct. 17. In annual terms, this should bring in $5M–$20M in revenue.

The problem? This money goes to the private Uniswap Labs company, not to UNI holders.

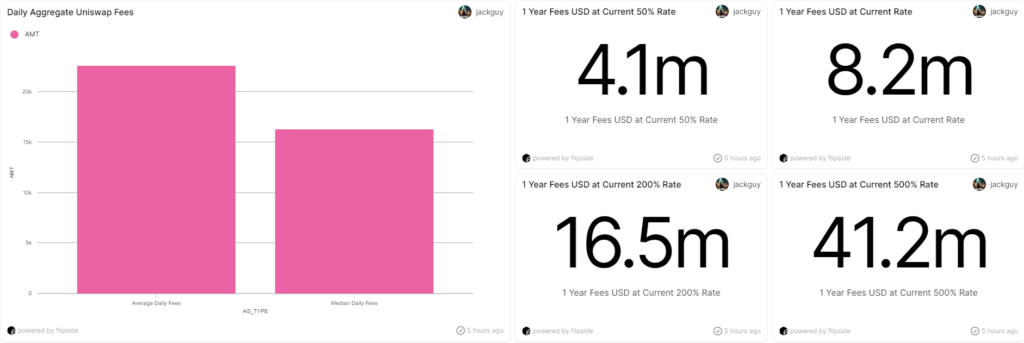

Projections of annualised fees going to Uniswap Labs (Source: Flipside via @jackguy)

Projections of annualised fees going to Uniswap Labs (Source: Flipside via @jackguy)

dYdX Approach: Fees Distributed

A few weeks after Uniswap Labs implemented its 0.15% fees, dYdX’s new appchain, dYdX Chain, launched.

On dYdX Chain, 100% of transaction fees go to validators and stakers. (Transaction fees include USDC-denominated trading fees and USDC- and DYDX-denominated gas fees from transactions.)

dYdX Chain rewards (Source: dYdX Foundation)

dYdX Chain rewards (Source: dYdX Foundation)

Given the significant volumes it attracts, there is excitement over dYdX’s revenue-earning potential. This year, dYdX surpassed $1 trillion in cumulative trading volume, which generated over $400M in fee revenue for dYdX Trading Inc. (Now that the dYdX Chain is live, the dYdX Foundation has stopped generating protocol revenue. As stated above, 100% of this revenue now goes to dYdX Chain validators and stakers.)

Should The Protocol Share Revenue?

Earlier this year, Matt created a conclusive post on the debate around whether to share protocol revenue with token holders.

He drew the analogy to how traditional companies approach dividend policies. Essentially, young companies are highly unlikely to redistribute excess profits, opting instead to invest in business growth. Click below for Matt’s post.

Read: When Will Token Holders Start Getting a Share of Protocol Revenue?

Matt and I agree that it may be too early in their life cycle to justify distributing revenue to token holders.

Very few DeFi platforms generate meaningful protocol revenue (i.e. fees paid directly to the protocol for usage). (Protocol revenue differs from supply-side revenue, which is paid to liquidity providers.)

If you take one thing away from this article, it is to zoom out. DeFi protocols can generate significant revenue in bull markets, even if most is supply-side revenue.

Growing Pressure To Share Fees

More DeFi platforms will likely follow dYdX’s lead—we have already seen DeFi platforms such as Curve, PancakeSwap, Trader Joe, and previously Sushi distribute protocol fees to stakers.

Given the revenue potential that would only spike in a bull market, this creates more pressure for Uniswap to turn on the fee switch.

This could force Uniswap’s hand—many hold UNI for the perceived value driver that the Uniswap protocol and treasury will generate revenue through activating the fee switch.

Is Regulation Holding Uniswap Back?

A significant consideration is whether most crypto protocols are holding off on the fee switch or distributing protocol revenue due to potential regulatory uncertainty. But unlike other protocols, Uniswap has not exited the U.S. market.

In 2021, Uniswap Labs drew attention from the SEC, with token holders activating the fee switch without proper legal consideration could present complexities. One primary concern is that directing Uniswap fees to token holders might raise questions regarding securities law.

For example, a proposed Uniswap fee pilot passed a temperature and consensus check on Snapshot last year yet failed to eventuate into anything. And then, in June, another proposal to pilot fees on some pools failed to pass a community vote mainly due to regulatory uncertainty.

Although legislation has been introduced to address the issue, it has not passed Congress or been signed into law…Following a holistic analysis, we do not feel comfortable recommending the creation of a traditional legal entity structure, if the proposal were to be approved right now.

Devin Walsh, Executive Director of Uniswap Foundation

And it’s not just Uniswap feeling the pressure. dYdX Foundation restricts U.S. citizens from using or validating the dYdX Chain.

Recap

Uniswap has yet to activate its protocol level fee switch, in part due to a legal concern. It is facing more pressure to change this, with the launch of dYdX Chain and a host of other DeFi protocols either activating protocol fees and or sharing it with token holders.

But DeFi platforms, and even Uniswap Labs’ private fee switch, show how much revenue could be captured, especially in bull markets.

A big theme I’m watching into 2024 is how Uniswap responds to this pressure to turn on the fee switch. If we see greater regulation and teams not afraid to assign value accrual to their cryptocurrencies, will Uniswap eventually redistribute value back to UNI?

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today