Making Sense of Polygon 2.0

Key Takeaways

- Polygon 2.0 is a framework to unify the many Polygon products and chains into one cohesive network.

- The change centres around 4 pillars:

- Connecting its many chains so the value can easily flow around the ecosystem.

- Polygon’s proof-of-stake ‘sidechain’ will become increasingly backed by Ethereum.

- Upgrading the MATIC token to POL, the utility of which will be vastly improved.

- Governance changes to improve decentralisation.

- The change represents a positive catalyst for Polygon to unite its ecosystem while also enhancing the native token’s utility.

- The main risks and drawbacks of Polygon 2.0 are execution risk and an increased token supply.

About Polygon 2.0

Over the last month, Polygon Labs unveiled an ambitious ‘End Game’ called ‘Polygon 2.0’, which is basically an attempt to unify the many Polygon products and blockchains into one cohesive network. As part of this, the MATIC token will get a design overhaul and a new name (i.e. POL).

The roadmap will significantly change governance parameters and transition its proof-of-stake (PoS) sidechain (i.e. Polygon PoS) to becoming increasingly backed by Ethereum.

Essentially, Polygon Labs is currently building multiple blockchains simultaneously—each with different purposes, tradeoffs and functions. With Polygon 2.0, these chains will become part of a unified network that is ultimately ‘secured’ by Ethereum’s security, using so-called ‘zero-knowledge technology’. Think of it as upgrading the shared infrastructure that powers the entire Polygon ecosystem.

There are 4 fundamental changes to understand with Polygon 2.0:

- All Polygon chains will unite in the Polygon 2.0 network

- Polygon PoS will become increasingly secured by Ethereum

- MATIC will become POL as part of tokenomic overhaul

- Decentralisation will improve with a renewed governance approach

Below, I break down these 4 changes!

The 4 Pillars Underpinning Polygon 2.0

1. All Polygon chains uniting in the Polygon 2.0 network

Polygon 2.0 is planned to be a network of many Polygon L2 chains where value easily flows around, and users need not worry about which chain they’re on.

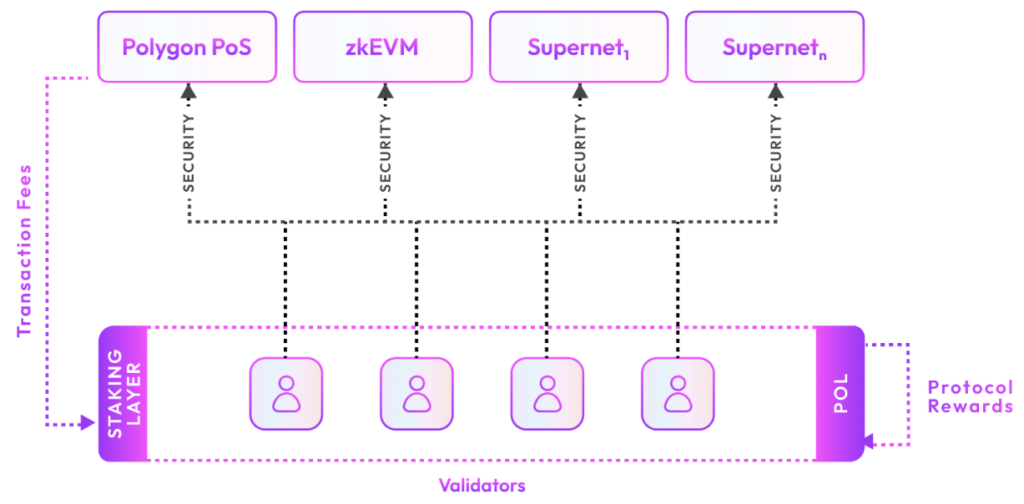

Diagram of Polygon 2.0, which includes Polygon PoS, Polygon zkEVM and Supernet chains (Source: Polygon Labs)

Diagram of Polygon 2.0, which includes Polygon PoS, Polygon zkEVM and Supernet chains (Source: Polygon Labs)

2. Polygon PoS to become increasingly secured by Ethereum

Today, the Polygon PoS sidechain is responsible for the vast majority of the value and users in the Polygon ecosystem, with $900M in total value locked and 400,000 returning addresses. However, Polygon PoS is maintained by a permissioned set of 100 validators. (Compare this with Ethereum, which currently has 718,976 permissionless validators.)

The transition will be slow. Once complete, Polygon PoS still won’t be entirely backed by Ethereum’s security. Nonetheless, it will be a major improvement relative to today’s sidechain. (For anyone interested, Polygon PoS will become a zkEVM validium rather than a zk-rollup. Crucially, validiums keep all transaction data offchain. Therefore, they aren’t as tightly secured by Ethereum as rollups, which publish some transaction data on Ethereum.)

When? Polygon Labs will submit an improvement proposal in the coming weeks. If approved, stage one of the transition should be done by year-end.

3. MATIC to become POL as part of tokenomic overhaul

Polygon 2.0 will centre around upgrading MATIC tokenomics and a rebranding to POL. This change aims to unite POL as the productivity token that powers many chains and the broader Polygon ecosystem. POL will have many different roles to participate in, from validator staking, rewards and community ownership. For example, POL will provide security for the upcoming Immutable zkEVM gaming chain.

The token will be used to provide utility or staked to perform different services, such as (i) validate many different Polygon-based chains, (ii) staked to provide sequencing of transactions, (iii) as a data-availability provider, and (iv) eventually, serving as a prover.

When? It needs to be voted on and approved.

POL will be integral to the Polygon 2.0 network (Source: Polygon Labs)

POL will be integral to the Polygon 2.0 network (Source: Polygon Labs)

4. Increased decentralisation with renewed governance approach

Polygon 2.0 will introduce a new governance framework for more decentralised control via a three-pillar approach:

- Protocol governance for anyone to propose an upgrade to any Polygon protocol.

- Ecosystem council for smart-contract upgrades.

- Community treasury governance introduces a two-phase community treasury for funding ecosystem projects.

When will Polygon 2.0 launch? It won’t happen all at once. Small upgrades on each pillar will gradually be approved and go live. For what it’s worth, The Block reported in late June that “the transition to Polygon 2.0 is slated to occur in the first quarter of next year, with progress being made throughout this year.”

Analysis: Is Polygon 2.0 Bullish or Bearish?

The Good

- The migration of Polygon PoS to Ethereum builds trust and loyalty. A risk was Polygon breaking its Ethereum alignment and spinning off on its own due to the overwhelming adoption of its sidechain, which remains one of the most heavily used blockchains.

- Upgraded tokenomics. The new POL token will be used in various ways throughout the Polygon ecosystem, and may end up having some of the most utility of any cryptocurrency in the market. This is a welcome change from the many unproductive cryptocurrencies that have limited utility beyond loosely defined ‘governance’.

- Clear plan to unite all Polygon chains. Simplifying the process and (hopefully) eliminating the need to bridge between the various Polygon chains should improve liquidity, user experience and network security.

The Bad

- Total supply to increase perpetually. POL won’t have a maximum supply, something that MATIC currently has. Included in the proposal is an annual inflation rate of 1% to fund the community treasury and POL rewards.

- Polygon 2.0 can be guilty of using excessive buzzwords such as “unlimited scalability”. It’s always a slight concern teams are making potentially unrealistic promises. To be fair, this could just be a case of over-the-top marketing.

- Ambitious new roadmap that requires significant execution time after R&D phase. While it’s unknown how much capital Polygon Labs is burning, its operating expenses are likely among the industry’s highest. The risk is a longer-than-expected transition and, combined with its other products and high developer costs, Polygon Labs may need to sell MATIC to fund development, eventually increasing sell-side pressure once sold tokens vest.

The Bottom Line

Polygon 2.0 is the biggest overhaul to Polygon since it rebranded from Matic Network in 2021. It certainly appears to be a positive catalyst for Polygon to unite its ecosystem and greatly enhance the native token’s utility.

As always, there are risks. The main concerns here are the removal of MATIC’s maximum supply and the high chance of a longer-than-expected transition, which would pressure Polygon Labs’ runway.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today