Maple Finance Plans To Fill Lender Void

Key Takeaways

- Maple continues to launch products, with the latest two being its Cash Management Solution and a direct lending desk.

- Combined with an injection of capital, it appears poised to take advantage of the void left behind by the industry’s collapsed lenders (e.g. BlockFi, Genesis, Celsius).

- Maple remains the market leader in onchain under-collateralised lending.

- Its priorities are surviving this bear market and positioning itself to capitalise on an eventual resurgence in the credit market.

Market Overview

The credit market dried up in 2022 as interest rates hiked, and the crypto market saw widespread contagion stemming from major exchange and lender bankruptcies. Fewer loans were being issued in the market, hurting Maple’s core business of credit and lending.

Last month, Maple surpassed $2B in loans originated since launch. Although it’s a milestone, this figure was $1.4B in May 2022, meaning that Maple originated only $600M in loans in the past 16 months.

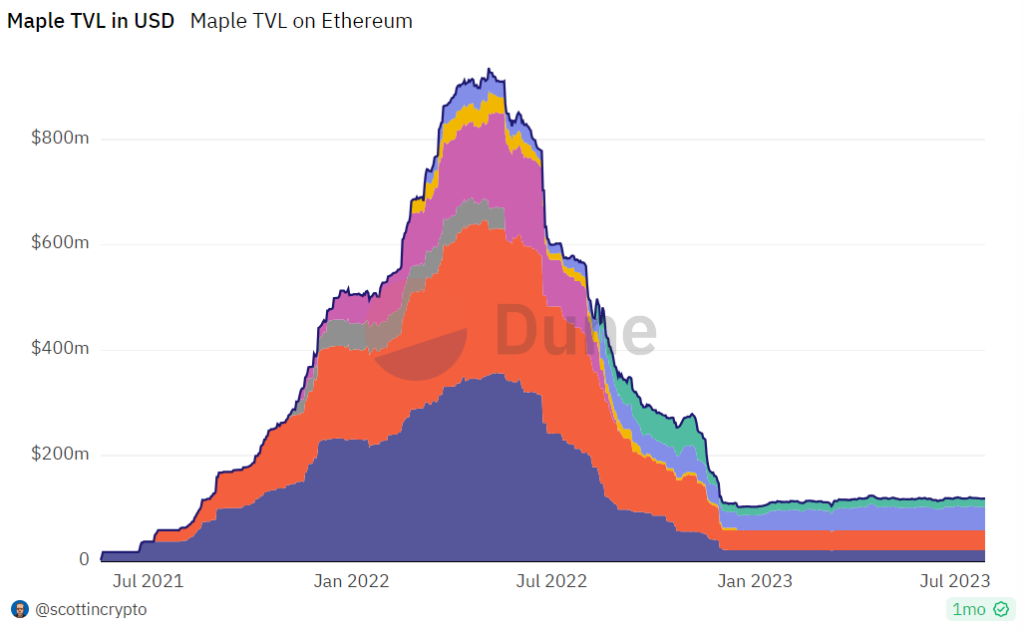

Likewise, due to the collapse of the credit market, Maple’s TVL remains at a two-year low of ~$120M, down 88% from its peak in mid-2022. These stats reflect how challenging things have been for crypto lenders of late.

Maple TVL in USD since May 2021 (Source: Dune board by @scottincrypto)

Maple TVL in USD since May 2021 (Source: Dune board by @scottincrypto)

Surviving the Credit Crunch of 2022

Maple almost didn’t survive the 2022 credit collapse. It had several issues with two large customers, Celsius and Babel Finance, going bankrupt. Maple also had exposure to Alameda Research, a default and misrepresentation by Orthogonal Capital’s lending pool, and a poorly time launch of a lending pool for bitcoin miners.

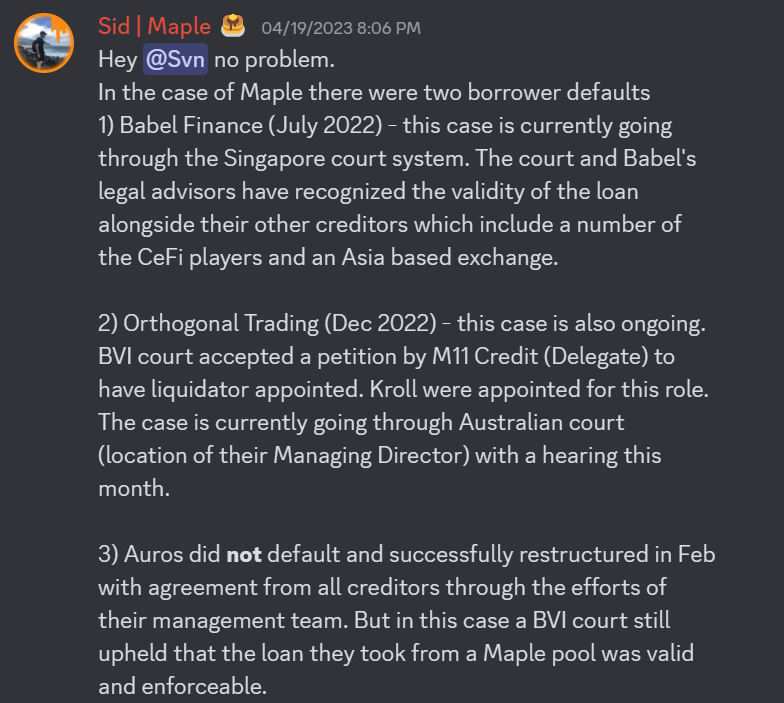

Update on ongoing court cases

Maple is in legal battles related to Babel Finance’s default and alleged misrepresentations made by Orthogonal Capital, which was one of Maple’s larger customers until it ended their relationship in June.

Latest update (Apr. 4, 2023) regarding Maple’s ongoing cases (Source: Maple Discord)

Positive Steps This Year

Despite the struggles, Maple has regained some momentum after a string of positive announcements covered below.

New products and regulatory approval

In recent months, Maple had three key developments:

Launch of Maple Direct, a direct lending desk. Opened in July, Maple Direct allows web3 businesses to access bespoke loans from institutional capital. The desk is operated by Maple’s founding team members.

Launch of Cash Management Solution in April. As covered in April’s Altcoin Report, this solution provides depositors with a simple way to gain exposure to U.S. Treasury yields. Since launch, the USDC pool has attracted more than 27M USDC in deposits. In July, the team launched a USDT pool, which has 612,471 USDT in deposits.

Opening of USDC pool to U.S. accredited investors. In a year of increased hostility from the U.S. towards crypto, the team surprised many by announcing that it received approval for the USDC pool of its Cash Management Solution to be accessed by U.S. accredited investors and entities. (Note, the USDT pool remains open only to entities not domiciled in the U.S.)

Support for Solana returns after an eight-month pause. The Cash Management Solution will be deployed on Solana in September, with CoinDesk reporting that “Solana-based protocols Solend, Drift and UXD Protocol committed to deposit funds at the beginning.” Solana network after 8 months, with multiple Solana-based protocols committing to deposit funds.

New funding and expansion

Encouragingly, Maple secured $5M in strategic funding co-led by BlockTower Capital and Tioga Capital. Maple will use the capital to expand deeper into Asia and Latin America and continue building Maple Direct.

The new funding will extend Maple’s runway. According to Sid in Maple’s Q2 community call, the team’s runway now takes them “well into 2025.”

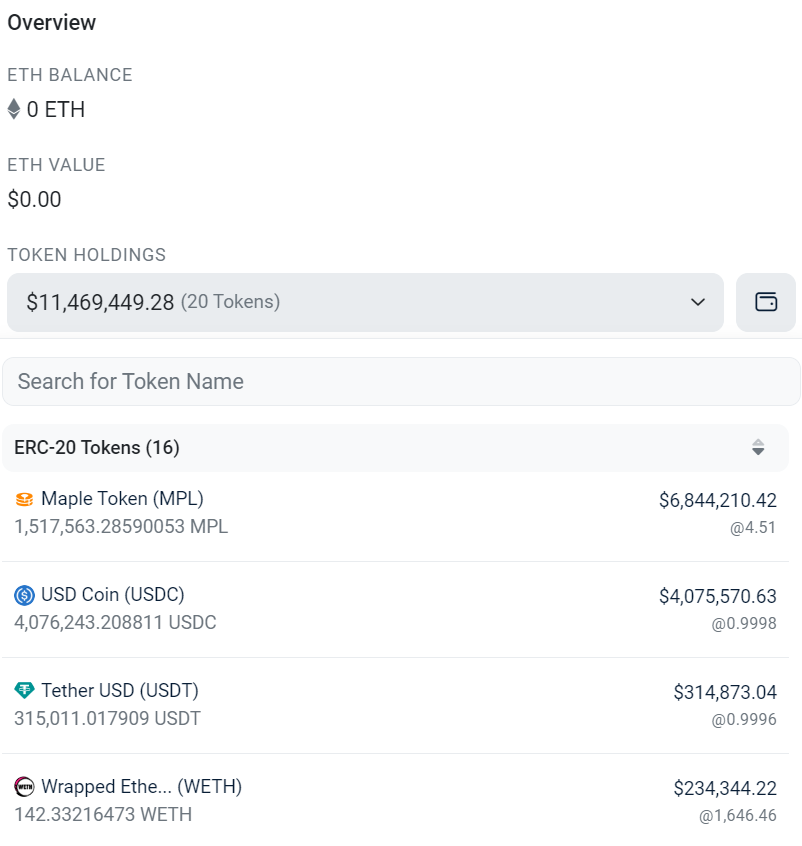

As per Maple’s known onchain addresses (shared below), the project is well capitalised.

- Maple Treasury (collects fee revenue for the protocol): 0xa9466EaBd096449d650D5AEB0dD3dA6F52FD0B19

- Maple DAO (holds balance sheet and governor of protocol): 0xd6d4Bcde6c816F17889f1Dd3000aF0261B03a196

- Maple Labs (receives grants and pays expenses): 0x94F98416CA0DC0310Bcaeda0e16903e19307539F

Holdings of the Maple DAO’s address, as of Sep. 8, 2023 (Source: Etherscan)

Remains a market leader

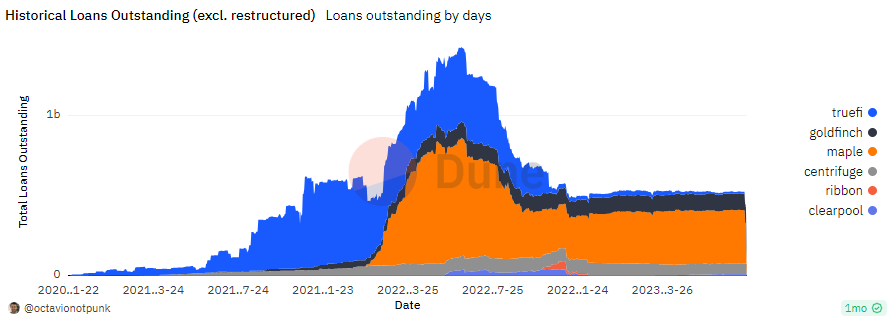

Maple has emerged from the 2022 crypto credit collapse retaining its market-leading position with a ~60% share of the under-collateralised lending market.

Historical loans outstanding by under-collateralised lender (Source: Dune board by @octavionotpunk)

Things To Watch In The Coming Months

Beyond rolling out and improving the above products, two important upcoming events for Maple are changing MPL tokenomics and possible L2 integration.

Changing MPL tokenomics

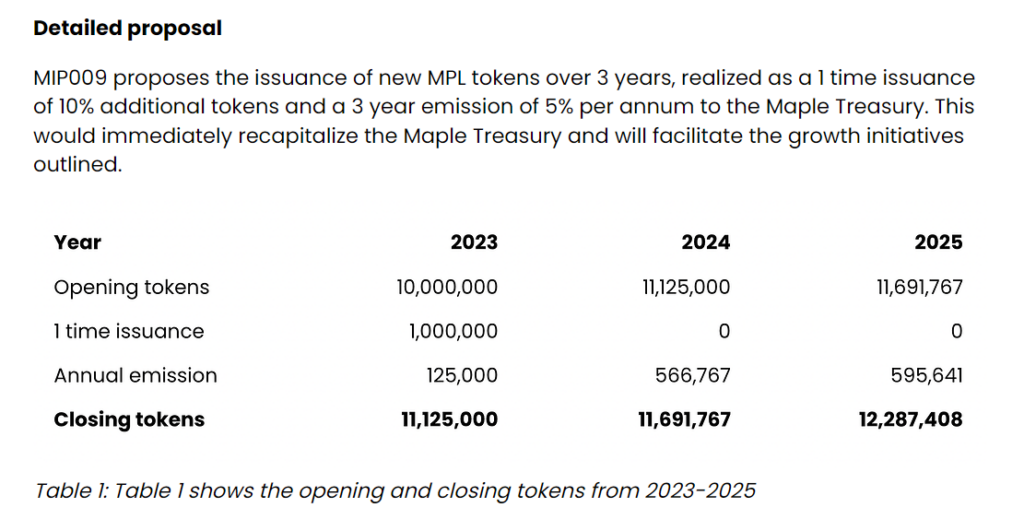

There appears to be strong initial support from within Maple DAO to alter MPL’s tokenomics, according to a recent governance proposal (MIP-009) to “upgrade the MPL token to MPLv2 to resource growth initiatives and add new MPL utility.”

This proposed new utility would include ecosystem grants and fee rebates for borrowers. However, accepting this change–at least according to the current version of the proposal—would result in the issuance of more MPL tokens over 3 years.

Important details included in the proposal (Source: MIP-009)

Important details included in the proposal (Source: MIP-009)

L2 integrations

In Maple’s Q2 community call, the team mentioned they were in “heavy discussions” with Ethereum L2 scaling solutions regarding a possible migration of parts of the Maple protocol so as to reduce user fees.

More details on Maple’s L2 strategy are possible before year-end. If they proceed, it could help increase user adoption for Maple.

Will Maple Capitalise On Centralised Lenders Collapse?

Maple has (so far) survived the crypto winter and subsequent credit collapse. Its new products and capital raise leave it poised to fill the void left behind after the collapse of some of the industry’s largest lenders (e.g. BlockFi, Genesis, Celsius).

A big reason these failed was their opaque operations. Maple aims to solve this through a hybrid model of offchain and onchain systems to provide greater transparency.

Separately, Maple may benefit from the two possible scenarios listed below.

- Banking de-banked crypto businesses: Maple could play a pivotal role in servicing these unbanked crypto firms due to banks’ rising negative attitudes towards the industry.

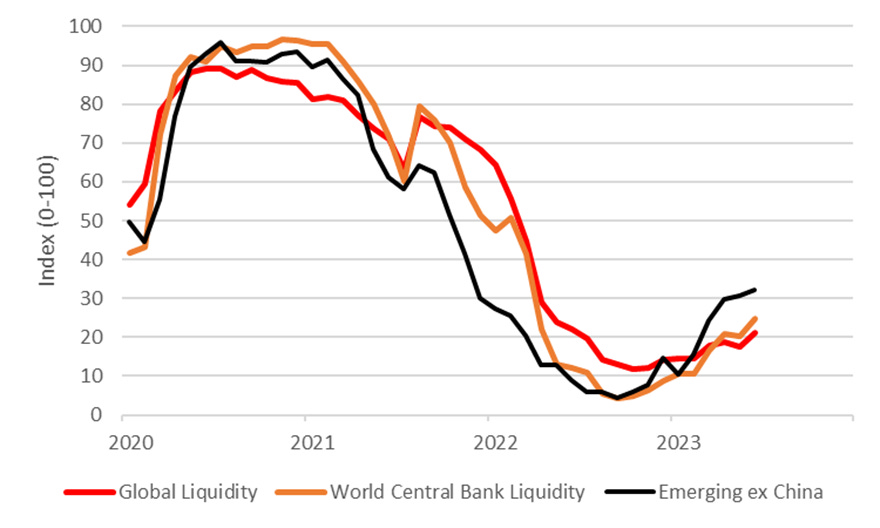

- Rise of liquidity: This year, the U.S. money supply has fallen at the fastest rate since the 1930s. Global liquidity has historically been correlated with crypto market performance. Maple would likely benefit from the return of improved liquidity conditions.

Indexes tracking global liquidity and central bank liquidity (globally and emerging markets excluding China), since January 2020 (Source: Capital Wars)

Indexes tracking global liquidity and central bank liquidity (globally and emerging markets excluding China), since January 2020 (Source: Capital Wars)

Questions Holding Maple Back

The time it takes for interest rates to fall

It is anyone’s guess as to how long it’ll be before the world’s central banks start to ease monetary policy. In other words, it’s currently unclear when central banks will start to lower interest rates. For Maple, it will be hoping an easing of monetary policy starts as soon as possible.

After all, interest rates are really just the cost of borrowing and lending money. As rates fall, demand to borrow and lend typically increases. Such a scenario would likely benefit a project like Maple, given that loan originations are a source of its fee revenue.

Gaps in transparency

Maple is yet to transition to fully onchain operations. It operates on a hybrid model that relies on offchain coordination (e.g. pool delegates, legal agreements).

Competition from Coinbase and others

Coinbase is also looking to fill the vacuum in crypto lending. Last week, Reuters reported that the exchange will soon launch a lending platform aimed at large institutional investors. Coinbase has raised $57M for this platform, as per a regulatory filing.

Adding to Maple’s competition, Trident Digital, a crypto-lending startup that exited stealth mode last week and announced an $8M seed round co-led by White Star Capital and New Form.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today