Proof of Work vs Proof of Stake

Proof of work (PoW) and proof of stake (PoS) are mechanisms used in blockchains such as Bitcoin and Ethereum. Each of them has advantages and disadvantages, and debate is ongoing about which is ‘better’. We explore these differences in this resource.

Key Takeaways

- Proof of work (PoW) and proof of stake (PoS) are algorithms that are foundational to blockchains like Bitcoin and Ethereum. They determine who gets to add the next block to the blockchain.

- In PoW, miners are chosen based on the amount of computation committed to the network (i.e. the ‘work’ in ‘proof of work’).

- In PoS, validators are chosen based on the amount of the blockchain’s native token staked to the network (i.e. the ‘stake’ in ‘proof of stake’).

- Each of them has advantages and disadvantages. Debate is ongoing over which is ‘better’, and there may never be widespread agreement over which is best.

What’s the Purpose of PoW & PoS?

PoW and PoS are schemes used by blockchains to make it harder for network participants to create a bunch of fake identities. Permissionless blockchains like Bitcoin and Ethereum need these schemes because of how easy it is for anyone to come and go to help run the network.

In PoW, transactions are validated and executed by miners, who use computation (which costs money) to solve a mathematical puzzle. The miner who solves the puzzle gets to mine the next block and earn its block reward.

(Importantly, unlike PoS blockchains, blockchains that use PoW have a separation of roles between miners and nodes. The importance of this separation can take a while for beginners to appreciate, and we intend on devoting an entire resource to this in the future.)

Examples of blockchains that use PoW are Bitcoin, Ethereum Classic, Litecoin, Monero and Decred.

"Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone. They vote with their CPU power, expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them."

-Satoshi Nakamoto

In PoS, transactions are validated and executed by validators, who are nodes that have locked up or staked a certain amount of the blockchain’s native token. Think of this stake as collateral against dishonest behaviour. For example, on Ethereum, you must stake 32 ETH to become a validator. Validators are randomly selected to validate the next block and earn its block reward.

Examples of blockchains that use PoS are Solana, Avalanche, Polkadot, Cardano, Algorand and Tezos.

PoW and PoS have many variants, particularly PoS. Each approach has different trade-offs. Debate is ongoing over which is ‘better’.

Circling back to the first paragraph, the most important thing to understand is that PoW and PoS require people to commit capital before they can participate in helping secure the blockchain. In PoW, miners spend money on hardware and electricity. In PoS, validators spend money on the blockchain’s native token.

Benefits of PoW

Grounded in the real world

PoW networks require real-world energy input. With each block that’s mined, the cumulative work of all miners increases. This makes it extremely expensive and challenging to attack PoW blockchains and reverse transactions—particularly older PoW blockchains with significant hash rates. There are logistical issues, too, as an attacker would also somehow need to acquire and operate a multitude of ASIC machines.

"To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes."

-Satoshi Nakamoto

Checks and balances between miners and nodes

PoW also arguably makes it harder to change how the network works. In 2017, over 80% of Bitcoin miner processing power, large exchanges and the biggest mining equipment manufacturer wanted to increase Bitcoin’s block size.

Despite strong initial support, this proposed upgrade didn’t pass. Lyn Alden and others argue that if Bitcoin was PoS, not PoW, then those who controlled the stake of coins could push through those changes.

"In the Bitcoin network, the real power rests with the nodes, rather than the miners. If miners try to collude and mine blocks that are invalid, the node network simply rejects those blocks."

-Lyn Alden

More straightforward

PoW is elegant, especially when compared to PoS. A simpler design reduces the risk of critical bugs that could result in a compromised network.

(Whilst not entirely due to PoW vs PoS, it’s still interesting to note that Bitcoin’s whitepaper is 9 pages, whilst Ethereum’s Gasper paper is 38 pages.)

Drawbacks of PoW

Dramatically more energy consumption

For PoW blockchains with a significant hash rate (e.g. Bitcoin), miners’ energy usage can be immense. This is probably the most common point of criticism of PoW.

The ongoing environmental debate over PoW is complex, as using energy isn’t necessarily bad. Many would argue that using energy to provide non-state money and open financial infrastructure is indeed worth it. Many miners also use renewable energy sources and some even mine with excess energy (i.e. energy that would otherwise go unused due to accessibility issues).

For a more nuanced discussion on Bitcoin’s energy usage, watch this video interview with Nic Carter.

Difficult for individuals to mine profitably

If a PoW blockchain gains a large enough hash rate and economic interest, it can lead to miner industrialisation. When this happens, well-capitalised mining companies can buy large quantities of mining equipment—often benefitting from economies of scale—which can leave the average person at a disadvantage.

Whilst this subject often elicits concerns over miner centralisation, there are several reasons why this doesn’t necessarily increase a PoW blockchain’s security risks. (For more on this, read Hasu’s CoinDesk column, ‘No, Concentration Among Miners Isn’t Going to Break Bitcoin‘.)

Similar to the energy point above, it’s subjective whether the industrialisation of PoW mining is a good thing. At least as far as individual Bitcoin miners are concerned, it’s made it extremely difficult to mine BTC profitably.

Benefits of PoS

Dramatically less energy consumption

PoS blockchains use significantly less electricity than their PoW counterparts. For example, Ethereum’s move from PoW to PoS is expected to reduce its energy consumption by roughly 99.95%.

Arguably more economically efficient

Because of the relative costliness involved with mining, higher coin issuance is needed to compensate. With PoS, the absence of mining allows for increased economic security efficiencies and therefore token issuance can be lower than PoW. For Ethereum, moving to PoS will cut ETH’s issuance rate by 60–80%. (For multiple reasons, it’s impossible to know precisely how much issuance will drop by.)

"How much issuance does the system need to have to pay for one unit of economic security? The way that we measure the security of a blockchain is through economic security, which is basically the number of dollars an attacker needs to overwhelm consensus and perform a 51% attack. Economic efficiency for proof of stake is on the order of 10–20x better than proof of work. That means we can drastically reduce issuance."

-Justin Drake (Ethereum Foundation)

Drawbacks of PoS

Centralisation risks

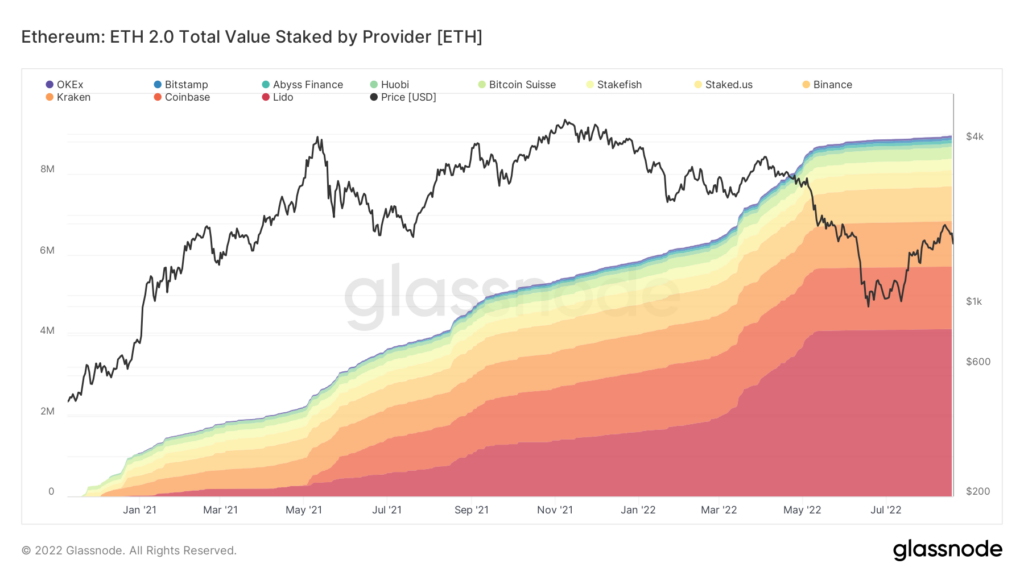

Centralisation is an issue for all PoS blockchains. For Ethereum, there’s a risk popular liquid-staking services like Lido will have too concentrated supply and a majority of ETH staked on centralised platforms like Binance or Coinbase.

Centralisation of staked ETH is already happening. At the time of writing, Lido holds 31% of total staked ETH and major exchanges hold a combined majority share.

This form of centralisation will likely continue due to (i) user convenience, (ii) challenges with accruing the minimum tokens required to become a validator and (iii) a general lack of interest or technical knowledge among holders to run their own nodes.

Whilst other liquid-staking-derivative protocols will continue launching, Lido has an enormous head start.

Another centralisation concern with PoS blockchains is how wealthy entities can amass relatively more staking rewards. For example, an entity with 3,200 ETH can set up 100 validator nodes, increasing their chance of being selected to validate a new block, relative to someone with one validator. Whilst this is true for miners in PoW blockchains, miners’ role separation with nodes alleviates concerns over collusion or cartelisation.

Government capturability

Somewhat related, with PoS, validators are arguably more susceptible to regulatory capture. With Ethereum, a majority of stake is centralised with regulated U.S. companies, meaning there’s potential for widespread censorship if the U.S. government orders certain addresses to be blocked. This was displayed when DeFi and wallet providers blocked certain users from their front-ends in response to OFAC’s sanctioned Tornado Cash addresses.

Younger and far more complex

Younger and far more complex

PoS is younger and less battle-tested than PoW. There just isn’t much empirical evidence to reference, which concerns some given that PoS is also far more complex than PoW. It may take decades before it becomes obvious which is ‘better’.

These complexities stem from the fact that PoS blockchains do everything ‘in-protocol’, unlike PoW where the ‘work’ requires hardware and electricity.

One of these complexities relates to randomness (i.e. how do you demonstrate that validators are being selected in a way that’s verifiably random?). With PoW, randomness is more or less donated to the protocol through miners solving a hashing problem, where the hash is random.

Going Deeper

Whilst mechanisms like PoW and PoS play a crucial role in enabling blockchains to reach consensus, they are not ‘consensus algorithms’ or ‘consensus protocols’. Instead, they are mechanisms designed to prevent Sybil attacks. (They are often referred to as ‘consensus protocols’ for simplicity.)

For a blockchain to achieve consensus, another important component is necessary. For example, Bitcoin uses PoW with the longest-chain rule (aka heaviest-chain rule); the combination of these is often referred to as ‘Nakamoto consensus’. As another example, Ethereum uses Gasper, a consensus protocol designed for a PoS blockchain.

For more on how blockchains reach consensus and the various algorithms used, watch the below workshop by Valeria Nikolaenko (a16z crypto Research Partner).

https://www.youtube.com/watch?v=mZ-Ya7NRDxM&embeds_referring_euri=https%3A%2F%2Fcollectiveshift.io%2Flayer-1%2Fproof-of-work-vs-proof-of-stake%2F&source_ve_path=MjM4NTE&feature=emb_title

Also, to learn about various attacks that are unique to PoS blockchains, watch another of Valeria’s workshops below.

https://www.youtube.com/watch?v=-uxHoEfxXC4

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today