U.S. Inflation Data Triggers Crypto Market Pullback

Market Highlights

- PCE Data Weighs on Risk Assets: Friday’s U.S. PCE report showed core inflation at 2.9% in July—inline with forecasts but higher than June—triggering a sell-off across equities and crypto.

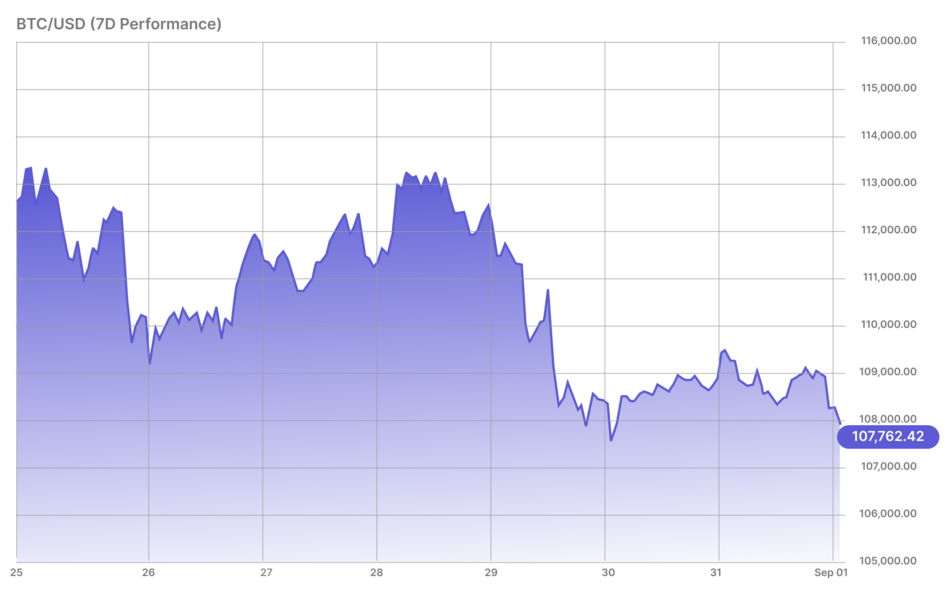

- BTC Marks First Monthly Loss in Five Months: BTC fell -4.47% on the week and -6.51% in August, posting its first negative month since March.

- ETH Rejects From All-Time Highs: ETH dropped -8.07% after failing to hold its all-time high breakout, though it still closed August up +18.81%.

- Altcoins Under Pressure: Large-cap tokens traded broadly lower, with DOGE, XRP and ADA leading declines.

- CRO Soars on Trump Media Treasury Deal: CRO jumped +86.79% after Trump Media & Technology Group announced a US$6.4 billion partnership with Crypto.com.

Market Overview

Crypto markets pulled back this week, with both Bitcoin (BTC) and Ethereum (ETH) retreating from recent highs while altcoins extended their declines.

The weakness followed Friday’s U.S. personal consumption expenditures (PCE) index, which showed core inflation running at 2.9% in July, inline with expectations but higher than June. The data weighed on risk assets broadly, with the S&P 500 closing down -0.6% and the Nasdaq down -0.9%. Crypto traded in step with equities, as the total market cap slipped more than -4% in the aftermath of the release.

Looking ahead, seasonality remains a potential headwind. September has historically been one of the weakest months for BTC, and with macro pressures still in play, market participants remain cautious that further downside could unfold in the weeks ahead.

Bitcoin (BTC)

BTC extended its losing streak, slipping -4.47% over the past seven days to mark a third consecutive week of declines. The move leaves BTC trading near US$107K, with price action consolidating after recent volatility. August closed with a -6.51% monthly decline, BTC’s first negative month since March.

ETF Inflows:

U.S. spot Bitcoin ETFs attracted US$440.7 million of inflows across the week, with Friday the only session to record net outflows, according to SoSoValue. Despite this, August flows finished negative overall, with ETFs posting net outflows of -US$751 million, underscoring waning investor conviction following July’s strong inflows.

Corporate Treasury Demand:

Amsterdam Bitcoin Treasury Strategy (AMBTS), established by Dutch crypto-asset service provider Amdax, has raised US$23.2 million in its initial financing round. The funding, secured through private placements, will seed the company’s bitcoin accumulation strategy. The round, capped at US$34.8 million, is expected to close in September 2025.

Strategy CEO Michael Saylor once again hinted at potential additional Bitcoin purchases. Overnight, he shared a chart visualising the company’s BTC accumulation over time. The post, captioned “Bitcoin is still on sale,” is part of a pattern of messages from Saylor that have often preceded announcements of fresh BTC acquisitions.

Ethereum (ETH)

It was a week of sharp reversal for ETH, which rejected firmly off fresh all-time highs. After coming within a whisker of US$5,000 the prior week, ETH pulled back to test key support around US$4,300, closing the week down -8.07%. Despite the correction, ETH still closed August with a monthly gain of +18.81%, underscoring the strength of its broader uptrend.

ETF Flows:

Price weakness did little to deter institutional demand. Spot ETH ETFs recorded over US$1.08 billion of inflows during the week, with Friday marking the only day of net outflows, according to SoSoValue. For August, ETH ETFs attracted nearly US$3.9 billion in total inflows, highlighting persistent institutional investor appetite.

Corporate Treasury Demand:

On the corporate side, SharpLink Gaming (SBET) disclosed the addition of 56,533 ETH to its balance sheet, bringing total holdings to approximately US$3.6 billion. The firm raised US$360.9 million in net proceeds last week and still retains US$200 million in cash, signalling potential for further ETH acquisitions.

Altcoins

Large-cap altcoins retreated across the board this week, with all majors posting losses. Binance Token (BNB) held up best, slipping -2.14%, followed by Solana (SOL) at -2.60%. Tron (TRX) declined -5.82%, ending its nine-week winning streak, while Dogecoin (DOGE) and XRP (XRP) dropped -7.81% and -8.23% respectively. Cardano (ADA) was the weakest performer, sliding -10.70% and extending its recent downtrend,

Biggest Gainers:

- Cronos (CRO) +86.79%: CRO soared after Trump Media & Technology Group announced a partnership with Crypto.com, revealing plans to acquire US$6.4 billion worth of CRO tokens to establish a large-scale crypto treasury.

- Pyth Network (PYTH) +48.91%: PYTH rallied after being selected by the U.S. Department of Commerce to provide on-chain verification and distribution of official economic data, including GDP figures.

- Story (IP) +26.55%: IP surged after the Story Foundation revealed a US$2.98 million token purchase as part of its ongoing US$82 million buyback programme running through mid-November.

Biggest Losers:

- Huobi (HT) -38.15%: HT slumped after traders locked in gains from last week’s pump, triggering a steep correction.

- Bio Protocol (BIO) -36.41%: BIO dropped as whales and traders took profits following last week’s Aubrai Ignition Sale, reversing its pre-launch momentum.

- CHEX Token (CHEX) -31.07%: CHEX plunged amid rumours suggesting millions of tokens were moved from team wallets to exchanges, fuelling concerns of insider selling.

ICYMI - The Week in Crypto News

Here are a few key stories you may have missed:

- US$2.5B+ in Solana DATs Announced: A wave of Solana Digital Asset Treasuries (DATs) are incoming, with Sharps Technology raising US$400 million, Pantera Capital reportedly planning a US$1.25 billion bid to acquire and rebrand a Nasdaq-listed company into “Solana Co.”, a publicly traded vehicle focused on holding SOL; and a Galaxy–Multicoin–Jump consortium preparing a separate US$1 billion SOL treasury initiative.

- B Strategy to Launch US$1B BNB Treasury Company: Digital asset firm B Strategy, with backing from YZi Labs (formerly Binance Labs), announced plans to launch a US$1 billion BNB Treasury company listed in the U.S.

- Trump Media Reveal US6.4B CRO Treasury Deal: Trump Media & Technology Group (DJT) announced a joint venture with Crypto.com to invest in CRO tokens as a treasury asset and pursue a public listing via a SPAC merger.

- UAE Revealed as 4th Largest Government BTC Holder: Arkham Intelligence identified wallets tied to the UAE government holding 6,300 BTC (worth ~US$740 million), ranking it among the top sovereign Bitcoin holders.

- Bitwise Files for Chainlink (LINK) ETF: Bitwise has filed to launch a spot ETF tracking Chainlink’s native token LINK, reflecting rising institutional interest in oracle networks.

- US Department of Commerce Publishes GDP Data Onchain: In a world-first, the U.S. Commerce Department has uploaded GDP figures to nine blockchains through partnerships with Chainlink and Pyth Network, enabling real-time macroeconomic data access across the DeFi ecosystem.

- Sonic Passes Proposal to Establish U.S. Entity: Sonic’s community approved a proposal to create a U.S.-based entity and launch a $S ETF, marking a key step toward U.S. market expansion.

- Pudgy Penguins Game 'Pudgy Party' Launches on iOS and Android: NFT brand Pudgy Penguins, in collaboration with Mythical Games, has launched Pudgy Party—a multiplayer mobile game now available globally on both Android and iOS.

Looking Forward - The Week Ahead

Key upcoming events to watch:

- Starknet Upgrade (1 September): Starknet v0.14.0 will go live on mainnet, introducing decentralised sequencing to the network.

- Ondo Finance Tokenised Stocks (3 September): Ondo is expected to launch tokenised stock offerings, bridging traditional equity markets with blockchain-based assets.

- U.S. Nonfarm Payrolls Data (5 September): Crucial labour market data will be released. Market participants will watch closely for signs of economic strength or weakness ahead of the next Fed meeting.

- Token Unlocks (1–7 September): Over US$41 million in token unlocks are scheduled this week, including Ethena (ENA) at US$26.39 million (0.64% of circulating supply), IOTA at US$2.88 million (0.42% of circulating supply), and Immutable (IMX) at US$12.55 million (1.27% of circulating supply).

Thanks for reading this week’s Market Pulse. We’ll be back next week with more insights from the crypto markets!

Disclaimer: This article and its contents are intended for informational purposes only, and do not constitute financial, investment, trading or any other advice from TWMT Pty Ltd, trading as Coinstash AU ("Coinstash"). Coinstash is not a licensed financial advisor and does not provide financial advice. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this webinar or relevant materials without undertaking independent due diligence and consultation with a professional financial adviser. The information presented in this article may be inaccurate and no representations are made as to its truthfulness or accuracy. The views and opinions expressed in the quoted material are those of the original authors and do not necessarily reflect the views of Coinstash. All quotes have been used for informational purposes and have been attributed to their respective sources to the best of our ability. You understand that you are using any and all information available in or through this webinar or relevant materials at your own risk. Cryptocurrency is a highly volatile and risky investment. You should consider seeking financial, legal, tax or other professional advice to check how the information relates to your unique circumstances. Coinstash shall not be held responsible or liable for any losses, whether due to negligence or otherwise, stemming from the use of, or reliance upon, the information provided directly or indirectly in this article.

Contents

Market Overview

Bitcoin (BTC)

Ethereum (ETH)

Altcoins

ICYMI - The Week in Crypto News

Looking Forward - The Week Ahead