Weekly Market Wrap - 19/05/25

Bitcoin Closes In on All-Time Highs as Altcoins Cool Off

Market Highlights

- Bitcoin (BTC) posted its highest weekly close ever, as it inches closer to its all-time high price.

- US Spot Bitcoin ETFs attract over US$2.8B in monthly inflows.

- WIF and HYPE outperform in a mixed week for altcoins.

- FTX to distribute over US$5B to creditors starting 30 May.

Bitcoin (BTC)

Bitcoin (BTC) rose +2.58% over the past seven days, closing the week at approximately US$106,479 - its highest weekly close on record. This marks the sixth consecutive week of gains and places BTC within touching distance of its all-time high price. After trading in a tight range for most of the week, Bitcoin surged more than 3% on Sunday, ending the week on a strong note and pushing to within just a few percent of new price discovery.

Momentum was supported by a familiar signal from Michael Saylor of Strategy (formerly MicroStrategy), who posted one of his trademark orange-circle Bitcoin charts on Sunday. These posts have historically preceded major BTC purchase announcements, and this latest one likely hints at another buy to be revealed as early as today.

In other corporate news, Basel Medical Group, a Nasdaq-listed healthcare company, announced it is in exclusive negotiations to acquire up to US$1 billion worth of Bitcoin. The move would significantly bolster its balance sheet and position it as one of the most BTC-heavy firms in the healthcare sector. Meanwhile, Tether announced it has acquired nearly half a billion dollars’ worth of Bitcoin as part of a broader strategic initiative. The purchase sets the stage for the launch of Twenty One - a new Bitcoin treasury company backed by Tether, Bitfinex, Cantor Fitzgerald, and SoftBank - which plans to go public on the Nasdaq through a SPAC merger.

Adding to the momentum, U.S. spot Bitcoin ETFs have attracted more than $2.8 billion in net inflows so far this month. Unlike previous retail-driven rallies, this cycle is being shaped by institutional accumulation, steady interest rate expectations, and broader macro shifts that are drawing capital back into risk assets.

Ethereum (ETH)

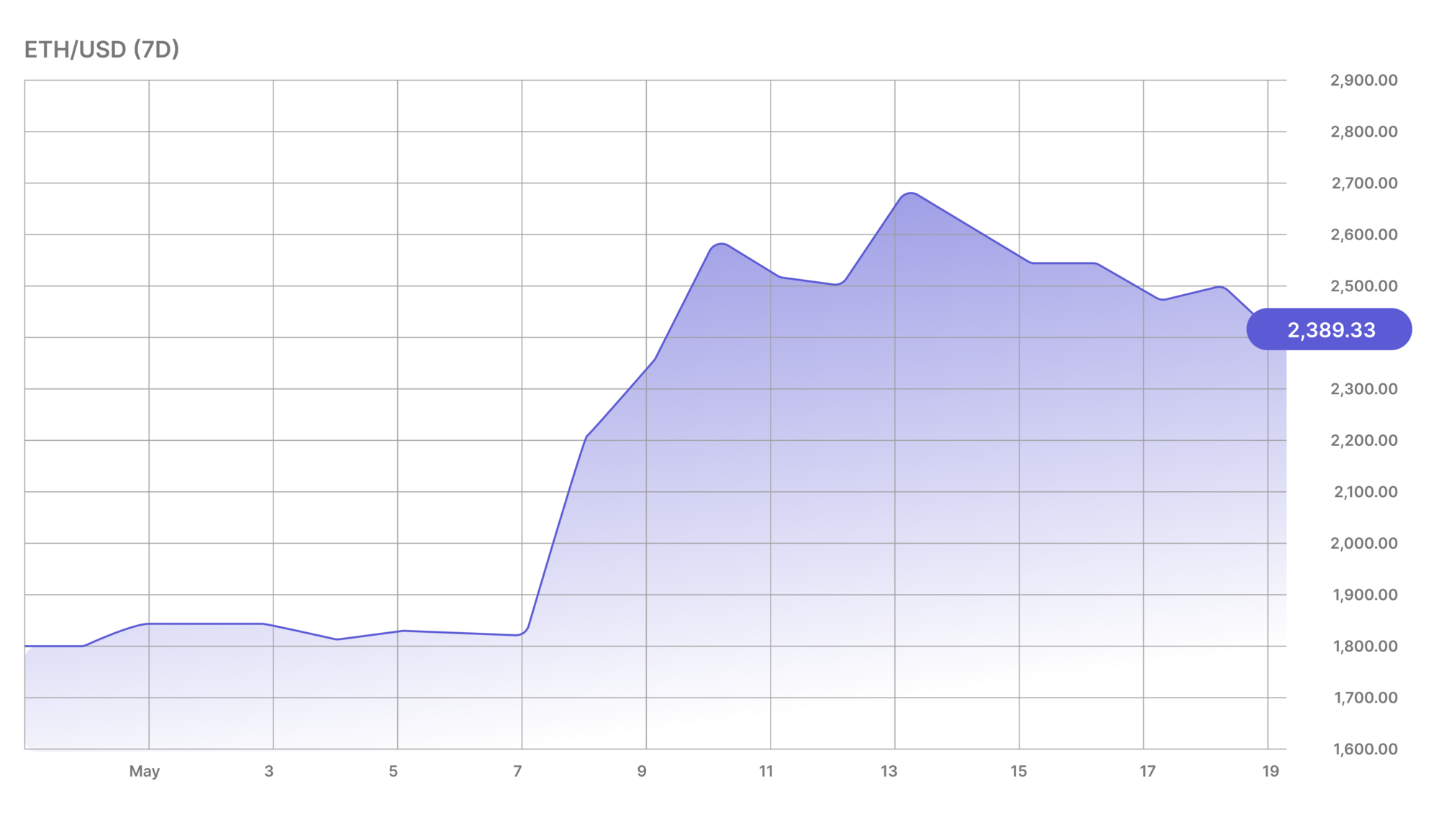

Ethereum (ETH) closed the week slightly lower, down -0.65 % to around US$2,498. Like BTC, ETH traded within a narrow range for most of the week, but unlike its counterpart, it failed to rally into the weekend and finished with a modest decline. This pullback follows a strong run earlier in the month, where ETH gained more than +40% following the successful Pectra upgrade on 7 May.

Despite the weaker close, Ethereum remained in the spotlight after a major announcement from the Ethereum Foundation. On Wednesday, the foundation introduced the Trillion Dollar Security Initiative, a long-term plan aimed at making Ethereum secure enough to support trillions of dollars in value and allow billions of users to confidently hold assets onchain.

Altcoins

The broader altcoin market delivered a mixed performance this week, with most large-cap tokens cooling off after a strong run in recent weeks. Solana (SOL) held steady, closing with a modest gain of +0.06%, while XRP (XRP) continued its recovery, rising +2.59%. Dogecoin (DOGE) also edged higher, up +0.53%, whereas Cardano (ADA) underperformed, finishing the week down -5.59%.

Among lower-cap assets, Dogwifhat (WIF) was one of the standout performers rallying +17.34%, reflecting sustained momentum in the meme coin space. Hyperliquid (HYPE) also continued its upward trend, gaining +8.94% as it continues to attract growing attention across the DeFi space.

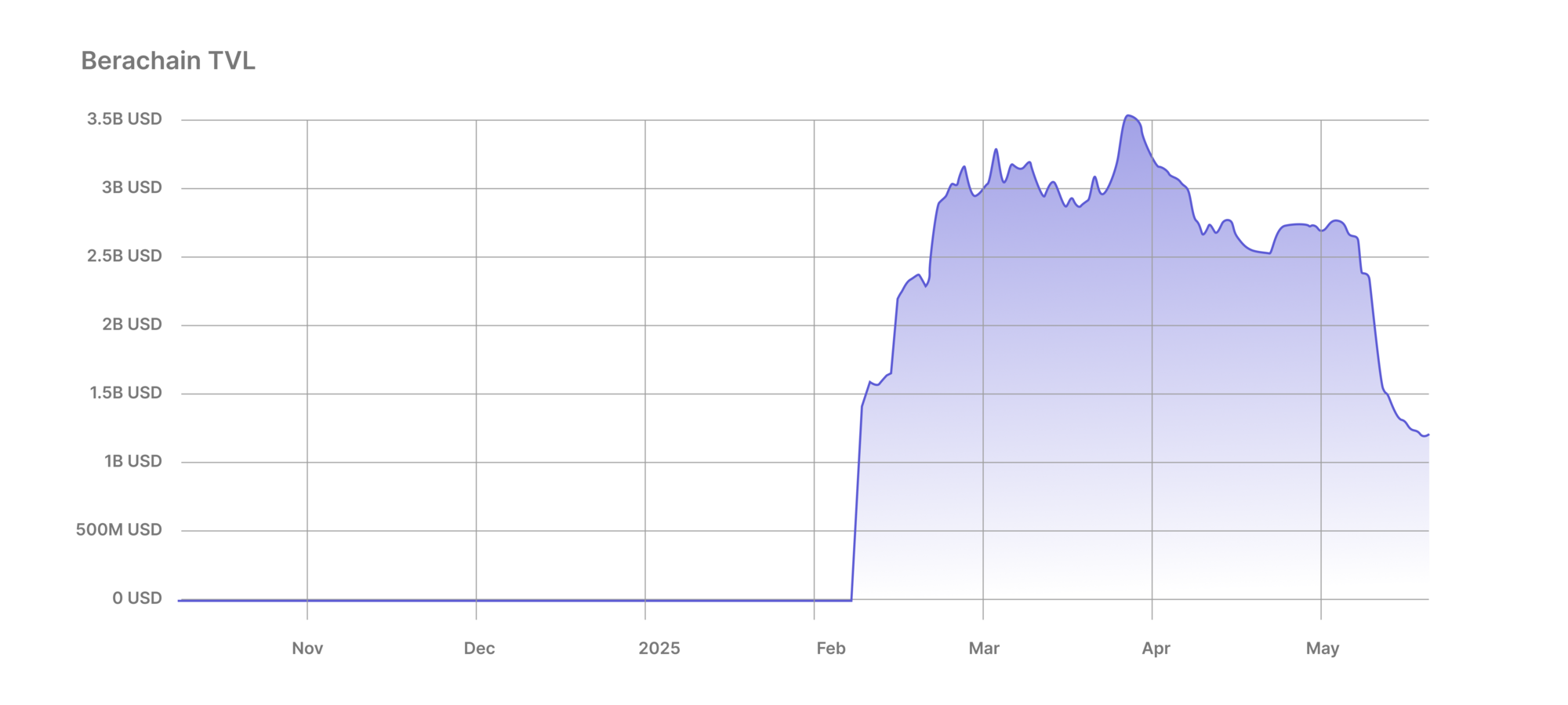

Among the worst performers this week was Berachain (BERA), which dropped -24.98%. As shown in the chart above, this decline aligns with a steady fall in on-chain activity since April, with the network’s total value locked (TVL) plunging from over US$3.5 billion to just US$1.19 billion so far this month. The sharp contraction in TVL highlights weakening user engagement and a loss of liquidity across the ecosystem.

In Other News

FTX creditors are set to receive a long-awaited round of repayments, with over $5 billion in recovered funds scheduled for distribution beginning May 30. The FTX Recovery Trust confirmed that more than 90% of claims have been approved, with payouts ranging from 54% to 120% depending on the nature and priority of each claim. While the process is far from over, the upcoming distribution marks a significant step forward for those impacted by the exchange’s collapse.

Coinbase made headlines for both the right and wrong reasons this week. The crypto exchange achieved a major milestone by officially joining the S&P 500, marking a significant step forward for mainstream crypto adoption. But the celebration was short-lived, as news broke of a US$20 million extortion attempt involving compromised customer data. According to reports, cybercriminals bribed overseas support agents to leak sensitive information, including names, addresses, masked bank details, and ID documents. Rather than pay the ransom, the company has offered the same amount as a bounty, calling on the public and authorities to help identify those responsible.

On the payments front, Mastercard continued expanding its digital asset initiatives through a new partnership with MoonPay. The collaboration will introduce stablecoin-powered payment cards, allowing users and businesses to send and receive stablecoins globally, with transactions automatically converted to fiat. The rollout will leverage infrastructure from Iron, a stablecoin payment platform acquired by MoonPay earlier this year, further bridging the gap between traditional finance and the crypto economy.

Looking Ahead

The week ahead brings a mix of regulation, celebration, and crypto spectacle.

The US Senate may vote as early as tomorrow on the GENIUS Act, a bipartisan bill that could establish the first federal framework for stablecoins. If passed, it would mark a major step forward for regulatory clarity in the sector.

Thursday is Bitcoin Pizza Day, celebrating the first-ever BTC transaction in 2010 when 10,000 BTC were spent on two pizzas. Now a lighthearted crypto holiday, it serves as a reminder of how far the space has come.

And finally, President Donald Trump is hosting a private dinner for the top 200 holders of his TRUMP meme coin - an event blending meme coin culture with political theatre, and drawing plenty of attention across the crypto world.

Disclaimer: This article and its contents are intended for informational purposes only, and do not constitute financial, investment, trading or any other advice from TWMT Pty Ltd, trading as Coinstash AU ("Coinstash"). Coinstash is not a licensed financial advisor and does not provide financial advice. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this webinar or relevant materials without undertaking independent due diligence and consultation with a professional financial adviser. The information presented in this article may be inaccurate and no representations are made as to its truthfulness or accuracy. The views and opinions expressed in the quoted material are those of the original authors and do not necessarily reflect the views of Coinstash. All quotes have been used for informational purposes and have been attributed to their respective sources to the best of our ability.You understand that you are using any and all information available in or through this webinar or relevant materials at your own risk. Cryptocurrency is a highly volatile and risky investment. You should consider seeking financial, legal, tax or other professional advice to check how the information relates to your unique circumstances. Coinstash shall not be held responsible or liable for any losses, whether due to negligence or otherwise, stemming from the use of, or reliance upon, the information provided directly or indirectly in this article.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today