What’s Next For Ethereum? Part 1: Scalability

With the Merge finally complete via a successful withdrawal activation, what’s next for Ethereum? In part 1 of this two-part series, I dive into why the focus shifts towards an upgrade targeting scalability to make Ethereum-like networks cheaper.

Key Takeaways

- This two-part series explains the Ethereum roadmap and upcoming upgrades to help you understand the jargon.

- Ethereum will introduce an upgrade towards the end of 2023 to jump-start scalability fixes to make Ethereum-like networks much cheaper.

- Longer-term scalability fixes will build on this upgrade but are longer away.

With the Merge officially over, what’s next for Ethereum?

You may have seen an informal roadmap full of jargon such as ‘Danksharding’, ‘EIP-4844’, ‘Proposer-Builder Separation (PBS)’. And that’s without mentioning confusing names of each phase (e.g. ‘Surge’, ‘Verge’). What does this all mean?

My goal with this two-part series is to synthesise what’s next for Ethereum while using minimal jargon. I’ll cover the development pipeline, what Ethereum developers are prioritising, and why it matters to you.

Ethereum’s Goal: To Achieve Visa-Level Scaling

Before diving into what’s next for Ethereum, let’s touch on Ethereum’s goal. This will help you understand the list of priorities.

Ethereum aims to be a global network home to a new digital economy where anyone can relatively cheaply deploy apps and secure value or information without relying on one centralised party. While the Ethereum blockchain has come incredibly far, reality is that transaction costs still get unsustainably high far too often.

While many alternative blockchains (e.g. Solana, Avalanche) are orders of magnitude cheaper to use, they remain relatively centralised and unreliable.

Scaling to Visa-like levels

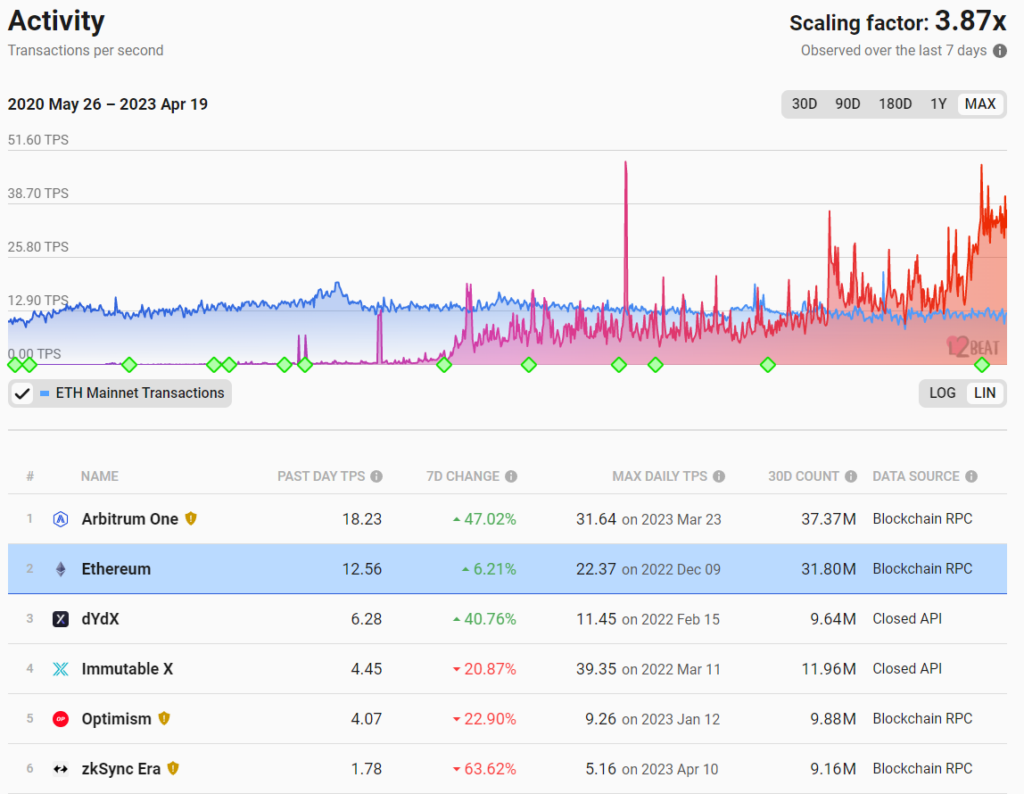

The ultimate goal is 100,000 transactions per second (TPS) across many Ethereum-like networks called rollups. Simply put, a rollup is simply a network tied to a blockchain such as Ethereum that retains certain security guarantees and is relatively cheap to use.

Ethereum can only do ~12 TPS and rollups (e.g. Optimism, Arbitrum) lag far behind Visa’s maximum of ~60,000 TPS.

The two key takeaways to understand are:

1. Ethereum is relying on Ethereum-like networks (i.e. rollups) to scale.

2. Rollups are still under development and, compared to Visa, are relatively costly to use.

L2BEAT Activity (Source)

L2BEAT Activity (Source)

The Tentative Roadmap

The Merge was only the beginning of Ethereum’s roadmap towards mass adoption. Below are the names of the remaining 5 areas of the roadmap.

1. The Surge: Scaling Ethereum.

2. The Scourge: Tackling centralisation risks to help preserve Ethereum’s credible neutrality.

3. The Verge: Reducing the requirements to verify Ethereum.

4. The Purge: A ‘clean-up’ phase to simplify Ethereum.

5. The Splurge: Everything else and minor optimisations to ensure a smooth Ethereum.

All stages are being worked on in parallel, some with relatively more resources.

Scaling, The Next Major Focus

The next major upgrade, called Proto-Danksharding or EIP-4844, will be centred around scaling. It will drastically lower the costs for Ethereum-like networks to operate.

This upgrade will kickstart Ethereum’s scaling journey and is a giant step to making Ethereum transactions on these other Ethereum-tied networks cost less than a cent.

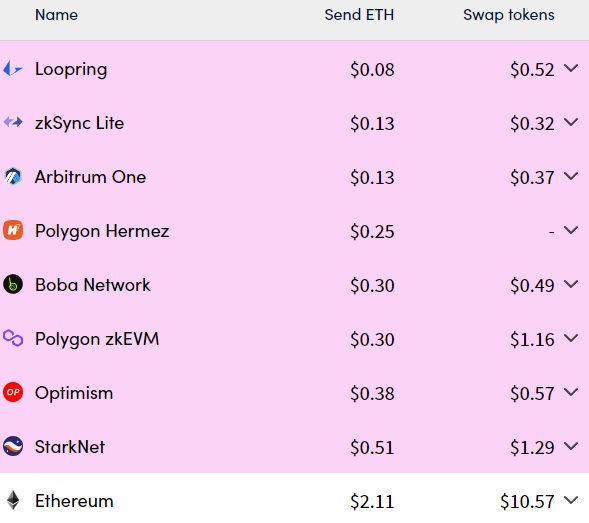

As per the below screenshot, on Ethereum-like networks, it typically still costs $0.10–$0.30 to send ETH, $0.20–$0.80 to swap tokens, and more than $1.00 to do more complex transactions. Sure, this is a big improvement compared to directly using Ethereum. However, this is still far too expensive for average users.

L2 Transaction Fees (Source)

L2 Transaction Fees (Source)

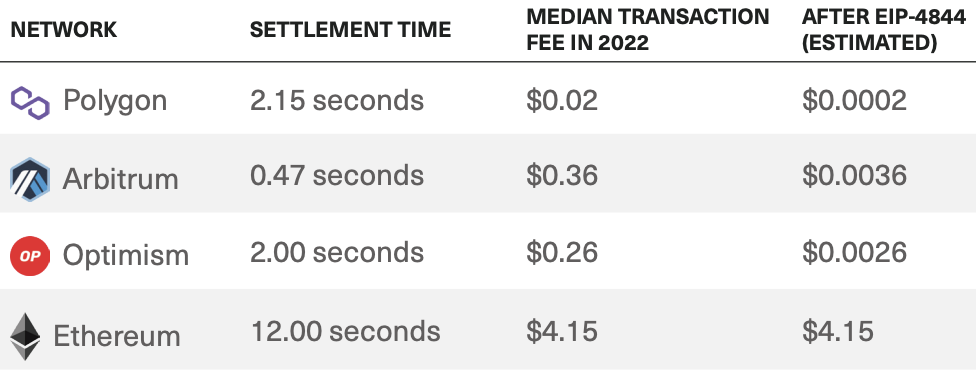

Why it matters: After EIP-4844, median transaction costs on Optimism, Polygon and Arbitrum should fall by more than 99%, helping drive more usage of Ethereum.

Median transaction fees in 2022 on Ethereum, Polygon, Arbitrum and Optimism (Source: Bitwise)

Median transaction fees in 2022 on Ethereum, Polygon, Arbitrum and Optimism (Source: Bitwise)

When will this scalability upgrade arrive?

Promisingly, the upgrade is ahead of schedule thanks to developer resources being deployed by Coinbase, Optimism and the Ethereum Foundation. It may go live by year-end as part of Ethereum’s next major upgrade (i.e. Cancun/Deneb).

Will it solve all the issues?

No, it will only reduce fees on Ethereum-like networks. However, the upgrade is only the start and will kickstart the journey as longer-lasting upgrades will build on EIP-4844.

Worth noting, improving scalability will likely increase demand, which could lead to more congestion sooner rather than later.

This same thing (i.e. induced demand) already happens in most cities whenever a new lane is added to an already popular freeway. Congestion eases initially, but the extra capacity and lower wait times attract more drivers, eventually leading to congestion.

Future Scalability Plans

EIP-4844 is only the start. There will be room for further improvements to tweak the parameters and decrease L2 networks’ costs to settle to Ethereum.

These additional scalability gains will be realised once more upgrades can enable Danksharding, which is basically EIP-4844, but on turbo. Danksharding promises to put the afterburner onto Ethereum-like networks, making them much more capable of sustaining mass usage with cheap fees.

If EIP-4844 is the appetiser, Danksharding is the main course. Danksharding is the full realisation of EIP-4844 to bring massive amounts of space to post data on Ethereum.

Why is it important? It’s here where serious scalability happens.

When? Danksharding will arrive much later after more Ethereum upgrades go live. I don’t expect it to happen before 2025.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today