DCA: The Case for Consistency

The Role of Dollar Cost Averaging (DCA) in Building a Generational Wealth Portfolio

Why the smartest capital in Bitcoin doesn’t try to time the market and what the numbers actually show.

The Familiar Problem

Generational wealth is rarely built in a single transaction. It’s built over decades, through compounding returns in equities, accumulating investment properties across market cycles, reinvesting profits from a business you built from the ground up, and having the foresight to allocate into assets that your children and grandchildren will thank you for. The pattern is always the same. Patience. Discipline. A willingness to think beyond your own lifetime.

For a growing number of high-net-worth families, Bitcoin is becoming part of that equation. Not as a speculative trade. Not as a punt on next month’s price. But as a long-term, supply-constrained asset that may play a meaningful role in a multi-generational wealth strategy.

The question, then, is not whether to allocate — it’s how. And for investors who think in decades rather than days, the answer may be simpler than expected.

What Is Dollar Cost Averaging?

Dollar Cost Averaging is straightforward: you invest a fixed amount of money at regular intervals weekly, fortnightly, or monthly, regardless of the current price. When the price is high, your fixed amount buys less Bitcoin. When the price is low, it buys more. Over time, your average cost per Bitcoin smooths out, sitting well below the peaks and well above the troughs.

For experienced investors, this isn’t a novel concept. It’s the same principle behind salary-sacrificing into superannuation, reinvesting dividends in an equity portfolio, or making regular contributions to an investment trust. The mechanism is identical, the asset class is simply newer.

Why Dollar Cost Averaging Works Well for Bitcoin

Bitcoin is more volatile than most traditional asset classes. In any given year, it’s not unusual for the price to swing 40–60% in either direction. For a lump-sum investor, that volatility is the primary source of anxiety: what if I buy at the top?

For a DCA investor, that same volatility is an advantage. Drawdowns, which happen regularly in Bitcoin’s history, become accumulation opportunities. You don’t need to predict them. You don’t need to react to them. Your investment strategy already accounts for them.

The investor who shows up consistently through a bear market accumulates significantly more Bitcoin per dollar than the investor who waits for confirmation of a recovery.

This isn’t a retail-only approach, either. Institutional allocators routinely use systematic entry strategies when building positions in volatile asset classes. DCA is not a compromise, it’s a risk management framework.

The Numbers: Three DCA Scenarios

Theory is useful, but numbers are more persuasive. Below, we walk through three hypothetical scenarios using historical Bitcoin price data and a consistent monthly investment of $15,000 AUD. These scenarios are illustrative, they don’t account for transaction fees, tax implications, or platform costs — but they demonstrate the power of disciplined accumulation across very different market conditions.

Note: All figures are in Australian dollars. Bitcoin prices have been converted to AUD using approximate prevailing exchange rates for each period. Current portfolio values are calculated at an approximate Bitcoin price of A$96,000 (mid-February 2026). Past performance is not indicative of future results.

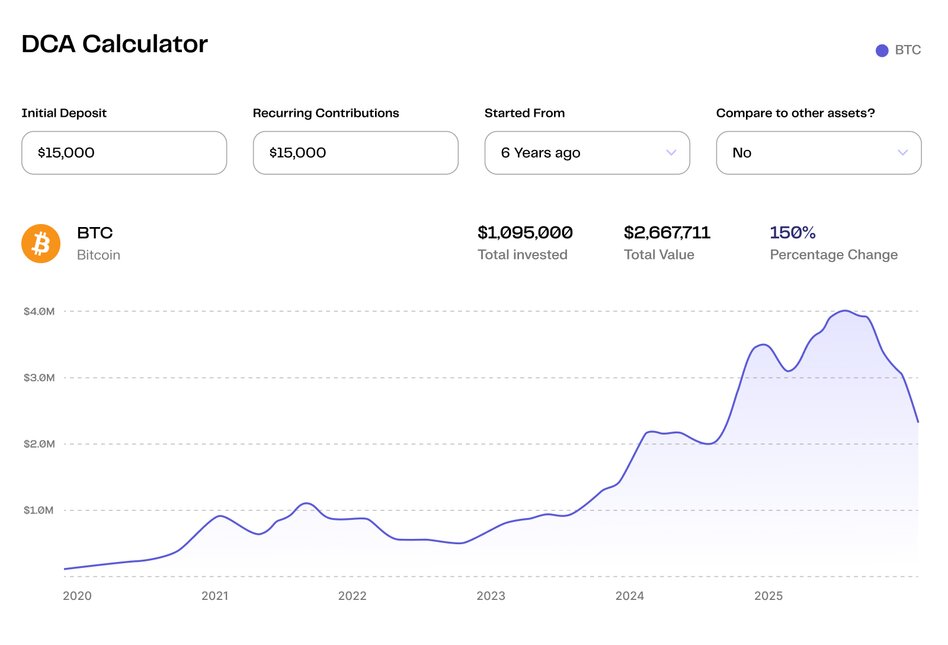

Scenario A: The Disciplined Investor

Start date: January 2020 | Monthly investment: $15,000 AUD | Duration: 73 months (~6 years)

This investor began accumulating in early 2020, just before COVID-19 upended global markets. At the time, Bitcoin was trading around A$10,400. Over the following six years, this investor lived through a pandemic crash, an explosive bull run, a brutal 75% drawdown through 2022, a recovery through 2023 and 2024, an all-time high above A$177,000 in October 2025, and the subsequent correction to today’s levels.

Through all of it, they invested $15,000 AUD every single month. No timing. No pausing. No panic selling.

An investor who deployed just over a million dollars over six years through simple, consistent monthly purchases now holds a position worth approximately $2.7 million — even after Bitcoin has corrected nearly 46% from its October 2025 highs. That’s the power of a low average cost built through discipline.

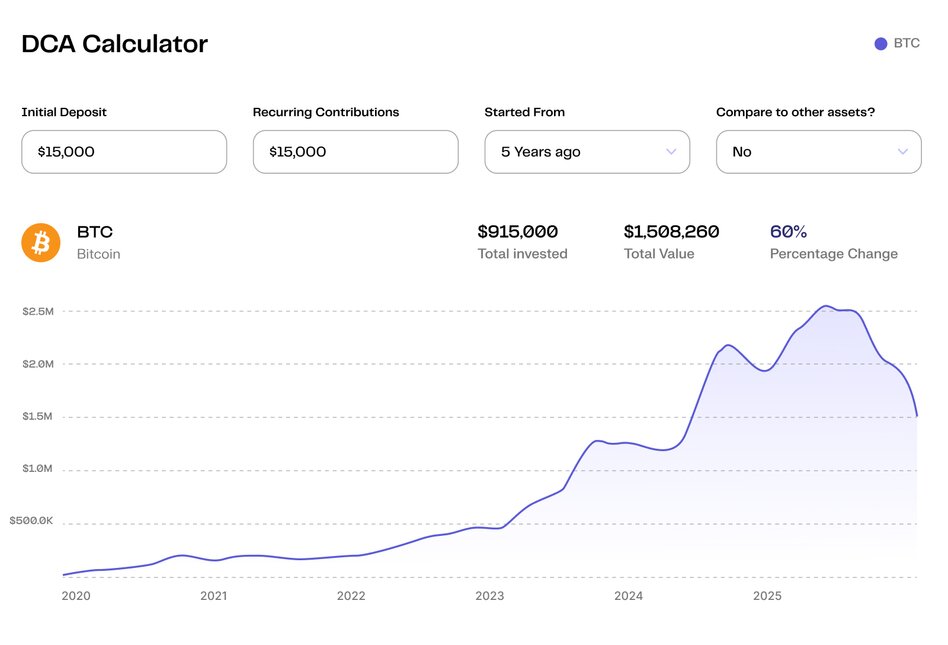

Scenario B: The ‘Worst Timing’ Investor

Start date: November 2021 (near the previous all-time high) | Monthly investment: $15,000 AUD | Duration: 51 months (~4.25 years)

This is the scenario every hesitant investor fears. Imagine you began your DCA strategy in November 2021, when Bitcoin was trading above A$84,000 and sentiment was at its most euphoric. Within months, the market collapsed. By late 2022, Bitcoin had fallen below A$26,000 in Australian dollar terms, a decline of over 75% from where you started.

Most lump-sum investors who bought near the peak in November 2021 would have been underwater for years. Many would have sold at a loss. But the DCA investor who kept buying through the drawdown? They accumulated significantly more Bitcoin at those lower prices, dramatically reducing their average cost.

This is perhaps the most important scenario in this article. Even an investor who started at objectively the worst possible time, the very top of the market, is now sitting on an unrealised gain of approximately $462,000 AUD, representing a 60% return on invested capital. That is the mathematical reality of what consistent accumulation through a bear market can deliver.

The investor who started at the worst possible time and never stopped buying is now sitting on a 60% gain. Timing didn’t matter. Consistency did.

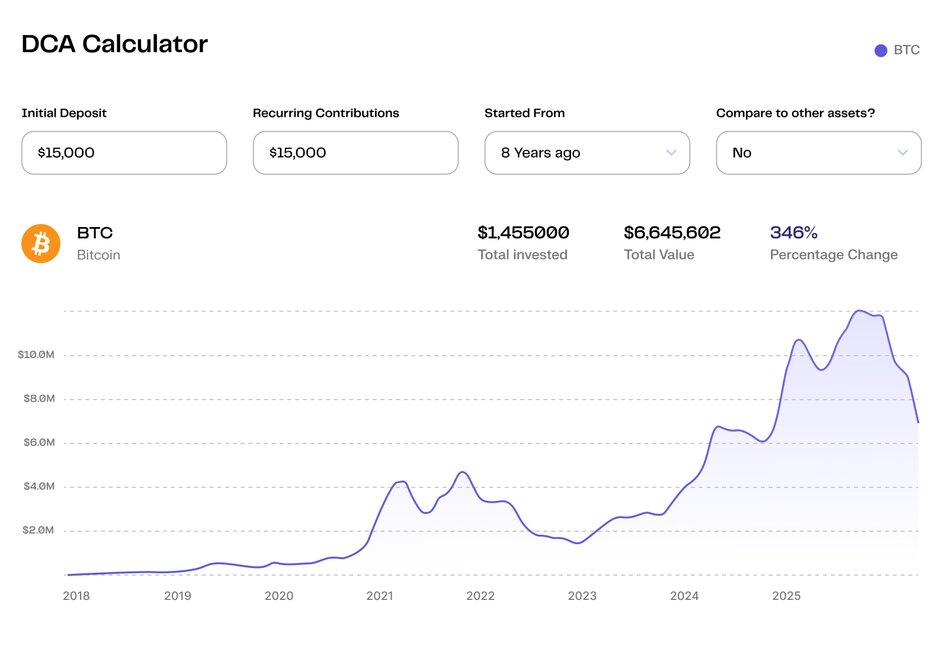

Scenario C: The Long-Term Accumulator

Start date: January 2018 | Monthly investment: $15,000 AUD | Duration: 97 months (~8 years)

This investor started their DCA journey in January 2018, when Bitcoin was coming off the euphoria of the 2017 bull run and was about to enter a painful year-long decline. Over the next eight years, they invested through two full bear markets (2018–2019 and 2022), two bull markets, a global pandemic, regulatory crackdowns, exchange collapses, and the emergence of Bitcoin ETFs.

Under $1.5 million deployed over eight years has produced a portfolio worth approximately $6.5 million. The average cost per Bitcoin of roughly A$21,450 means this investor has substantial downside protection — Bitcoin would need to fall a further 78% from current levels before their position moved into loss.

More importantly, this investor now holds nearly 68 Bitcoin. In the context of a network with a hard cap of 21 million coins, of which approximately 19.8 million have already been mined and a meaningful portion is believed to be permanently lost, that is a significant position in a supply-constrained asset.

Why Invest In Bitcoin?

For investors who have built their wealth in property, equities, or private business, the natural question is: why would I allocate capital to Bitcoin at all?

The answer is not about replacing what already works. It’s about diversifying into an asset with fundamentally different characteristics to anything else in a traditional portfolio.

Finite Supply

Bitcoin has a hard cap of 21 million coins, embedded in its protocol and enforced by a decentralised network of nodes. There is no central authority that can change this limit, no board that can issue more shares, no government that can print more. For investors who understand the long-term impact of monetary debasement on purchasing power, this is a compelling feature. It is, by design, the scarcest financial asset ever created.

Institutional Legitimacy

The approval of spot Bitcoin ETFs in the United States in January 2024 marked a turning point. Major asset managers — including BlackRock, Fidelity, and Invesco — now offer regulated Bitcoin investment products. Corporate treasuries, sovereign wealth discussions, and the establishment of strategic Bitcoin reserves at a national level have all contributed to Bitcoin’s transition from a fringe technology to a recognised asset class.

A New Category of Store of Value

Bitcoin is increasingly compared to gold — not because it replaces gold’s role in a portfolio, but because it shares key attributes: scarcity, durability, divisibility, and portability. Where Bitcoin diverges is in its accessibility and transferability. It’s digital and can be sent electronically across borders using decentralised networks. Transfers may happen without traditional financial intermediaries and can offer a transparent, publicly verifiable record. For investors who think globally, this matters.

Addressing the Hesitation

“It’s Too Volatile”

Volatility is not the same as risk. Risk is often considered the potential for permanent loss of capital. Volatility is the price you pay for asymmetric returns. Bitcoin’s annualised volatility has been steadily declining over time as the market matures, but it remains higher than most traditional assets. For a DCA investor, however, volatility can create opportunities to accumulate at a lower average cost. The scenarios above demonstrate that even extreme volatility, including a 75% drawdown, did not prevent a disciplined DCA strategy from generating significant positive returns.

“I’ve Missed the Boat”

This is what people said when Bitcoin reached US$1,000 in 2013. And when it reached US$20,000 in 2017. And US$69,000 in 2021. And over US$126,000 in 2025. At every point, the belief that it was “too late” would have been proven wrong by simply starting a consistent accumulation strategy and maintaining it. Bitcoin’s addressable market — as a global store of value, settlement layer, and reserve asset — is orders of magnitude larger than its current market capitalisation. Whether that potential is realised is an open question, but the thesis has never been about today’s price. It’s about where the asset sits in ten or twenty years.

“Regulatory Uncertainty”

Regulatory clarity has been increasing significantly. In Australia, simple crypto exchanges operate under AUSTRAC registration and anti-money laundering obligations. ASIC has also clarified how laws apply to digital assets, and the Digital Assets Framework Bill 2025 — creating a licensing regime — has passed the House of Representatives and is before the Senate.In the United States, the regulatory environment has shifted materially since 2024, with the approval of Bitcoin ETFs, executive orders establishing digital asset working groups, and the creation of a Strategic Bitcoin Reserve. Globally, the direction of travel is toward integration and regulation, not prohibition. For institutional and high-net-worth investors, this evolving regulatory framework actually de-risks the asset class over time.

The Generational Wealth Lens

For many of the investors reading this article, the question is not just whether Bitcoin deserves a place in their personal portfolio. The question is whether it deserves a place in their family’s long-term wealth strategy.

Consider the framing: there will only ever be 21 million Bitcoin. The global population is approaching 8 billion. If your family holds even a small amount of Bitcoin — accumulated patiently over years — you are securing a position in an asset with absolute scarcity. That is not a guarantee of future returns. But it is a thesis that resonates deeply with investors who understand what happened to the price of well-located property in Sydney, Melbourne, and Brisbane over the past 30 years. Scarcity, when combined with growing demand, tends to reward early and consistent participation.

Wealth that lasts generations is rarely built by timing markets. It is built by identifying asymmetric opportunities early, allocating consistently, and having the conviction to hold through volatility.

A DCA approach to Bitcoin fits naturally into a broader family wealth strategy alongside property, equities, superannuation, and business holdings. It is not an alternative to these pillars. It is an additional one — one that, unlike most traditional assets, your children and grandchildren can hold directly, in a self-sovereign manner, without reliance on banks, brokers, or intermediaries.

The Principle, Not the Prediction

This article is not a prediction about Bitcoin’s future price. Nobody knows where it will be in six months or six years. What we do know is this: across every historical timeframe longer than four years, a DCA strategy into Bitcoin has produced positive returns. Even investors who started at the absolute worst possible entry points have, with time and consistency, moved into profit.

The principle behind DCA is the same one that has driven wealth creation across every asset class, in every era: show up. Be consistent. Think in decades, not days. And let the mathematics of disciplined accumulation work in your favour.

If you are an experienced investor who has been watching Bitcoin from the sidelines, waiting for the “right time” to enter — the historical evidence suggests that the right time is not a moment. It’s a commitment to a process.

Disclaimer: This article and its contents are intended for informational purposes only, and do not constitute financial, investment, trading or any other advice from TWMT Pty Ltd, trading as Coinstash AU ("Coinstash"). Coinstash is not a licensed financial advisor and does not provide financial advice. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this publication or relevant materials without undertaking independent due diligence and consultation with a professional financial adviser. The information presented in this article may be inaccurate and no representations are made as to its truthfulness or accuracy. You understand that you are using any and all information available in or through this publication or relevant materials at your own risk. Cryptocurrency is a highly volatile and risky investment. You should consider seeking financial, legal, tax or other professional advice to check how the information relates to your unique circumstances. Coinstash shall not be held responsible or liable for any losses, whether due to negligence or otherwise, stemming from the use of, or reliance upon, the information provided directly or indirectly in this article.

BUY BITCOIN (BTC)

WITH COINSTASH

Contents

DCA: The Case for Consistency

What Is Dollar Cost Averaging?

Why Dollar Cost Averaging Works Well for Bitcoin

The Numbers: Three DCA Scenarios

Why Invest In Bitcoin?

Addressing the Hesitation

The Generational Wealth Lens

The Principle, Not the Prediction