Weekly Market Pulse - 08/09/25

Markets Rebound as Fed Rate Cut Odds Rise

Market Highlights

- September Fed Rate Cuts Now Fully Priced: August’s U.S. labour report showed just 22,000 jobs added, pushing market odds of a September rate cut to near certainty.

- BTC Breaks Losing Streak: Bitcoin rebounded 2.66%, closing the week higher and ending a three-week decline.

- ETH Faces Record ETF Outflows: ETH slipped -2.01% as spot ETH ETFs recorded US$787M in outflows, the largest on record.

- Buybacks Fuel Altcoin Outperformance: PUMP, MPLX, ENA were among the week’s top gainers, supported by token treasury and buyback strategies.

- Dogecoin ETF Anticipation Builds: The first DOGE ETF could go live as early as this week.

Market Overview

Crypto markets recovered this week, with Bitcoin (BTC) and most major altcoins posting modest gains after the prior week’s pullback. The rebound came as traders weighed a weaker-than-expected U.S. labour report against growing expectations of Federal Reserve rate cuts.

Friday’s report showed just 22,000 jobs were added in August, well below forecasts. The miss pushed the probability of a rate cut at the Fed’s 17 September meeting sharply higher, with some prediction markets assigning odds between 90% and 100%. Expectations for additional cuts in November and December also increased, driving Treasury yields lower and weighing on the U.S. dollar. A softer dollar is generally supportive for Bitcoin and risk assets more broadly.

The altcoin market saw several standout performers over the past week, with Digital Asset Treasuries (DATs) and token buybacks continuing to dominate as the key catalysts. Pump.fun (PUMP), Metaplex (MPLX), and Ethena (ENA) were among the biggest beneficiaries, each gaining momentum from buyback initiatives.

Looking ahead, the coming week is shaping up to be eventful, with multiple macro data releases on the calendar and the potential debut of the first Dogecoin ETF. If the ETF is approved, it could spark a rotation into the meme coin sector, provided broader market conditions remain supportive.

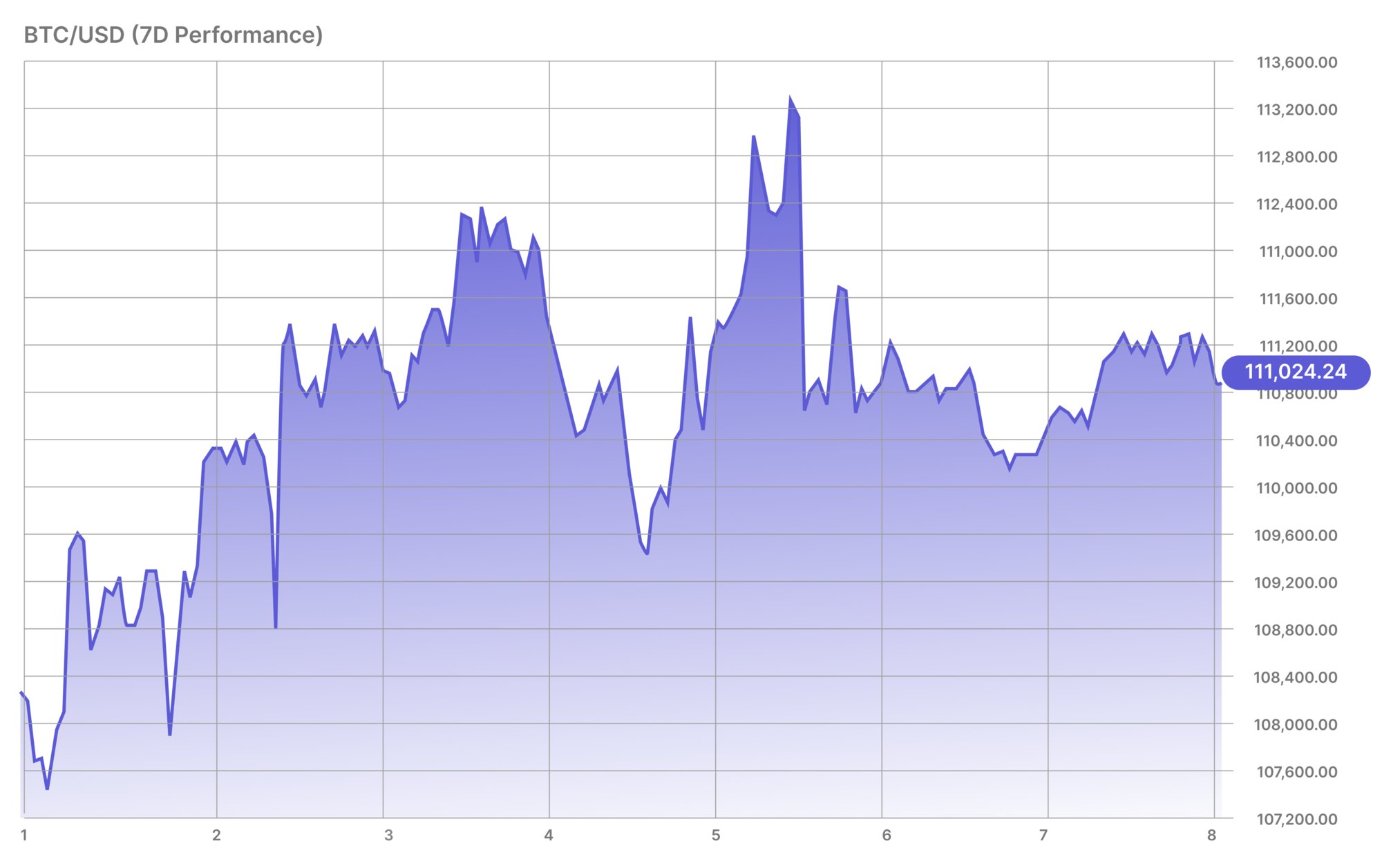

Bitcoin (BTC)

BTC found support at ~US$107K last week, with buyers stepping in to defend the key support level. The move sparked a rebound that saw BTC close the week up +2.66% at ~US$111K, breaking a three-week losing streak. The question now is whether BTC can carry this momentum forward and shake off September’s reputation as one of its weakest months.

ETF Inflows:

U.S. spot Bitcoin ETFs recorded US$246 million of inflows over the week, their second consecutive week of net gains. It marked the largest inflow in nearly a month and provided some support for BTC’s rebound.

Corporate Treasury Demand:

MicroStrategy continued its accumulation strategy, with Michael Saylor confirming the purchase of 4,048 BTC worth ~US$449.3 million last week. Saylor has already hinted at further acquisitions, posting another chart on X overnight with the caption “Needs More Orange.” Meanwhile, El Salvador’s Bitcoin Office marked the fourth anniversary of the country’s Bitcoin legal tender law with the symbolic purchase of 21 BTC.

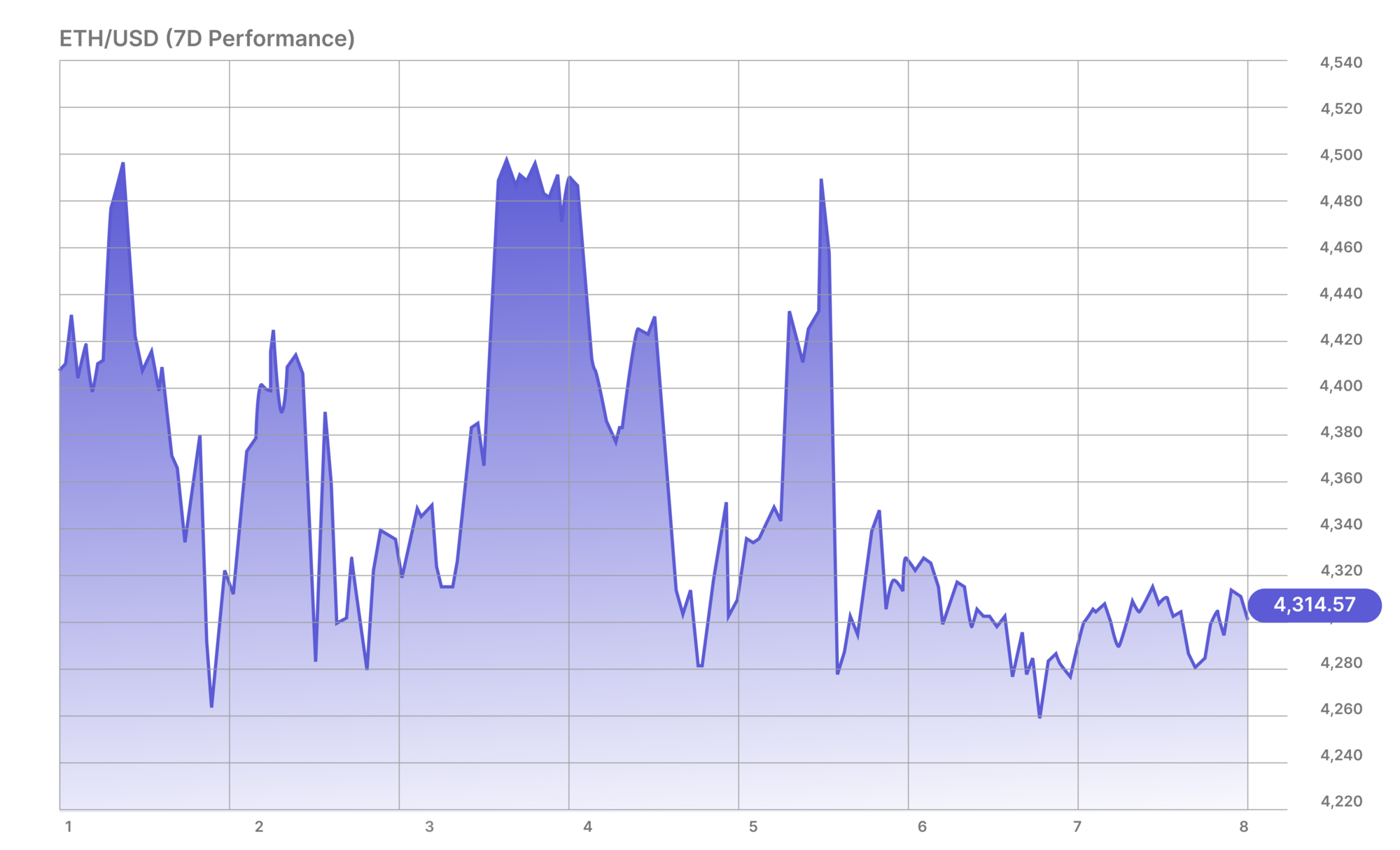

Ethereum (ETH)

ETH’s retreat from recent all-time highs extended this week, with the asset closing down 2.01% at ~US$4,300. A further move lower towards the key support level at ~US$4,000 remains possible unless buyers step in to stabilise price. The slide has been fuelled by unprecedented ETF outflows, which drained nearly US$800M from spot ETH products over the past week.

ETF Flows:

U.S. spot ETH ETFs recorded their largest weekly outflows on record, with over US$787 million exiting the products, according to SoSoValue. The persistent withdrawals have weighed heavily on price momentum.

Corporate Treasury Demand:

Institutional interest in ETH treasuries remains strong despite ETF weakness. SharpLink Gaming (SBET) added another US$176 million worth of ETH last week, bringing its total holdings to 837,230 ETH, now valued at nearly US$3.6 billion. Meanwhile, Yunfeng Financial Group, linked to Alibaba co-founder Jack Ma, became the latest publicly listed firm to adopt an ETH treasury strategy, purchasing 10,000 ETH worth approximately US$44 million.

Altcoins

Large-cap altcoins posted modest gains this week, with all major assets in the green except Tron (TRX). Dogecoin (DOGE) led the pack, climbing 7.02% amid growing excitement over the potential launch of the first Dogecoin ETF this week. XRP (XRP) rose 3.65%, Cardano (ADA) gained 2.92%, Solana (SOL) added 2.86%, and Binance Token (BNB) was up 2.59%. TRX declined 2.89%, snapping its recent upward momentum.

Biggest Gainers:

- Pump.fun (PUMP) +44.43%: PUMP was the biggest gainer over the past week, as it continues its aggressive token buyback initiative, purchasing over US$12 million worth of tokens last week. The buyback program has now reached nearly US$72 million in total value since inception. These purchases have reduced PUMP’s circulating supply by 5.36%, creating deflationary pressure on the token.

- Numeraire (NMR) +38.28%: NMR surged after JPMorgan committed US$500 million to Numerai’s AI-powered hedge fund, effectively doubling its AUM and validating its institutional appeal.

- Metaplex (MPLX) +35.23%: MPLX has benefitted from sustained buybacks by the Metaplex DAO, which is allocating 50% of protocol fees to repurchase tokens. The continued reduction in circulating supply is helping to ease sell side pressure.

- Ethena (ENA) +15.19%: ENA climbed as StablecoinX, a treasury company linked to the project, raised US$530 million to expand its ENA accumulation strategy. The firm has already acquired 7.3% of the circulating supply and aims to reach 13% through further spot market purchases over the next 6–8 weeks.

ICYMI - The Week in Crypto News

Here are a few key stories you may have missed:

- SMSFs in Australia Now Hold AU$3.12B in Crypto: New ATO data shows that crypto holdings in self-managed super funds nearly doubled in a year, rising from AU$1.7 billion to AU$3.12 billion between June 2023 and June 2024.

- Stripe and Paradigm Reveal New Layer-1 Blockchain 'Tempo': Payments giant Stripe and crypto VC firm Paradigm have partnered to launch Tempo, a new Layer-1 blockchain designed specifically for payments and stablecoin infrastructure.

- Hyperliquid to Launch USDH Stablecoin: Hyperliquid has reserved the USDH ticker and opened proposals for teams to issue the stablecoin. Validators will vote via on-chain governance, with the winning team selected once quorum is reached.

- StablecoinX Raises US$530M for ENA Treasury Strategy: StablecoinX announced it has raised an additional US$530 million to expand its ENA accumulation plan. The firm will purchase locked ENA from a subsidiary of the Ethena Foundation, which is using the proceeds to buy ENA on the spot market.

- Sora Ventures to Launch US$1 Billion Bitcoin Fund in Asia: Taiwan-based Sora Ventures announced plans to raise US$1 billion to support Bitcoin treasuries across Asia. The fund will launch with US$200 million in initial capital, targeting a further US$800 million over the next six months.

- Ondo Finance Launches Tokenised U.S. Stocks: Ondo has released tokenised versions of 100+ U.S. stocks and ETFs on Ethereum, backed by real assets held with U.S. broker-dealers.

- Arbitrum Launches US$40M DRIP DeFi Incentive Program: Arbitrum has launched its DRIP initiative, distributing 24 million ARB tokens over 20 weeks to boost DeFi activity across the ecosystem.

- Solana Approves Alpenglow Upgrade: Solana validators passed the Alpenglow upgrade, a revamp of the network’s consensus model expected to reduce transaction finality time by 5x. Testnet deployment is set for December, with mainnet release in Q1 2026.

- Bitcoin Hash Rate Hits New All-Time High: Bitcoin’s single-day hash rate reached a record 1.279 EH/s on Tuesday, with the seven-day moving average also hitting an all-time high, underscoring growing network security.

- First Dogecoin ETF May Launch Next Week: A Dogecoin ETF could hit U.S. markets as early as next week, according to Bloomberg analyst Eric Balchunas. REX Shares and Osprey Funds have filed to launch the REX-Osprey Doge ETF under ticker DOJE, offering direct exposure to DOGE’s price performance.

Looking Forward - The Week Ahead

Key upcoming events to watch:

- SOL Strategies Nasdaq Listing (9 September): SOL Strategies will become the first Solana-focused treasury company to list on Nasdaq.

- Sonic (S) Token Unlock (9 September): Approximately US$44.64 million worth of S tokens (5.02% of circulating supply) will be unlocked. The event could introduce short-term selling pressure depending on market demand.

- Linea Token Launch (10 September): Linea's long-anticipated token generation event is set to go live, positioning it as one of the largest token launches of 2025.

- U.S. PPI Inflation Report (10 September): Producer Price Index data will be released at 10:30 PM AEST. As a forward-looking inflation indicator, this release may influence market sentiment ahead of upcoming Fed decisions.

- Aptos (APT) Token Unlock (11 September): Around US$48.18 million in APT tokens (2.20% of circulating supply) will be unlocked. Market impact will depend on liquidity and investor appetite.

- U.S. CPI Inflation Report (11 September): Consumer Price Index data will be released at 10:30 PM AEST. This is a key input for Federal Reserve policy expectations and could move both crypto and equity markets.

- Starknet (STRK) Token Unlock (15 September): US$15.70 million in STRK tokens (5.98% of circulating supply) will be unlocked, potentially increasing supply-side pressure if investor demand is low.

Thanks for reading this week’s Market Pulse. We’ll be back next week with more insights from the crypto markets!

Disclaimer: This article and its contents are intended for informational purposes only, and do not constitute financial, investment, trading or any other advice from TWMT Pty Ltd, trading as Coinstash AU ("Coinstash"). Coinstash is not a licensed financial advisor and does not provide financial advice. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this webinar or relevant materials without undertaking independent due diligence and consultation with a professional financial adviser. The information presented in this article may be inaccurate and no representations are made as to its truthfulness or accuracy. The views and opinions expressed in the quoted material are those of the original authors and do not necessarily reflect the views of Coinstash. All quotes have been used for informational purposes and have been attributed to their respective sources to the best of our ability. You understand that you are using any and all information available in or through this webinar or relevant materials at your own risk. Cryptocurrency is a highly volatile and risky investment. You should consider seeking financial, legal, tax or other professional advice to check how the information relates to your unique circumstances. Coinstash shall not be held responsible or liable for any losses, whether due to negligence or otherwise, stemming from the use of, or reliance upon, the information provided directly or indirectly in this article.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today