Why Solana Continues To Impress

Key Takeaways

- Solana has bounced back after a near-fatal 2022 threatened its very survival.

- Solana continues to impress, showcasing many technical developments, increasing network durability and legitimate partnerships or integrations (Visa & Shopify).

- Institutional investors are feeling the positives, with SOL posting 27 weeks of net inflows this year, compared to only four weeks of sell-offs.

- Despite the positive signs, onchain activity remains yet to catch up with other fundamentals. A focus will now be on whether these positives translate into sustained usage.

A Year Of Positives

Solana has bounced back this year after a horror 2022, filled with network downtime and an exodus following the collapse of FTX. Solana shows a wide range of positives that cannot be underestimated, such as:

- High-profile profile legitimate partnership adoption

- A new infrastructure upgrade

- Increasing network uptime

- Mobile development

- Cheap “compressed” NFTs

Record investment inflows

The positives are translating into institutional interest. While the rest of the crypto ecosystem struggles, SOL has 27 weeks of net inflows this year, compared to only four weeks of sell-offs.

Visa & Shopify Adoption

Visa: Global payments giant Visa announced in early September it would expand its USDC stablecoin settlement program to Solana.

Shopify: In late August, Solana Pay was integrated as a plugin option inside Shopify, allowing merchants and users to harness Solana as a low-cost way to settle payments.

FireDancer Upgrade

Solana’s yearly conference, Breakpoint (Oct. 30–Nov. 3), is fast approaching, with several announcements likely, most notably, Firedancer. It is a client for Solana critical to improving Solana’s infrastructure. Firedancer promises to:

- make Solana more durable and secure;

- help scale the network through faster and more concurrent transactions;

- lower the cost of running a validator node, and

- help decentralise the network.

In a recent interview with Solana Labs co-founder and CEO Anatoly Yakovenkoy, he expects the team to “get something out by Breakpoint,” but it won’t be a full release.

Growing Network Strength & Decentralisation

The reliability of Solana improved noticeably this year.

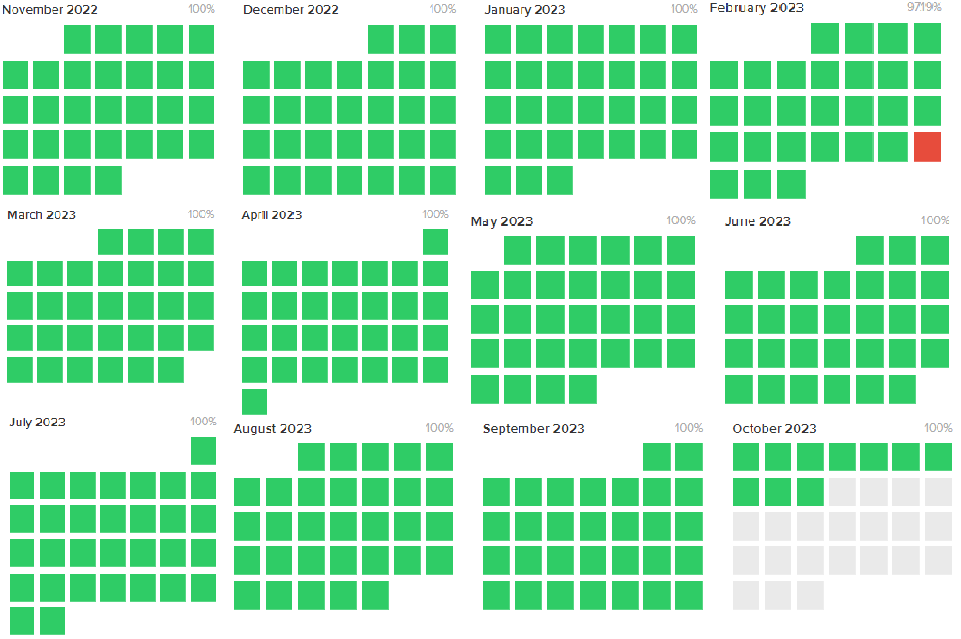

Since Feb. 25, Solana has experienced 100% uptime. (For those unaware, in 2021 and 2022, Solana suffered multiple well-documented instances of network downtime and severe performance degradation.)

This is particularly positive, given Solana implemented multiple upgrades to ensure users do not experience high gas fees when a single application demands high resources.

It shows the substantial upgrades in the last 12 months have proven effective.

Solana network uptime (Source: Solana Status)

Solana network uptime (Source: Solana Status)

Solana has also progressed from a single to a multi-client network—making the network more resilient & secure—and continues to rank highly for the number of validators and nodes.

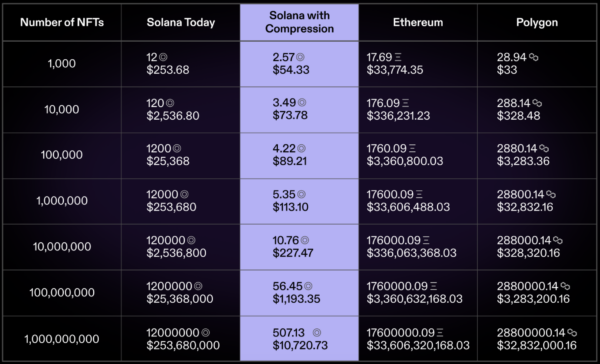

Compressed NFTs

NFT minting volume has taken off due to “compressed NFTs”, allowing users to mint 1 million NFTs for ~$110.

For more, see 5 Reasons Why SOL Has Staying Power

For more, see 5 Reasons Why SOL Has Staying Power

Mobile Development

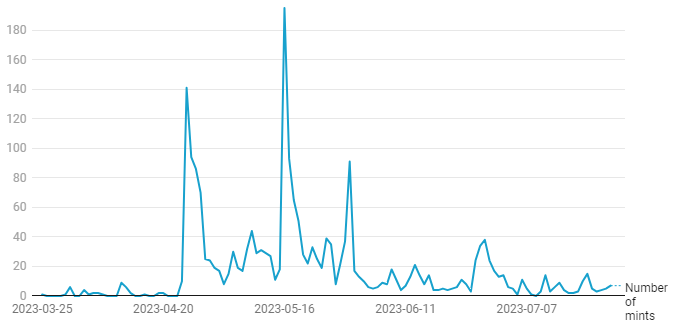

Finally, the Solana mobile experience remains in its infancy, with Solana Labs shipping The Solana Saga smartphone in May.

However, it is yet to see any real adoption, with only ~2K minters of its Genesis NFT mint available to early buyers. The high price point and low sales forced Solana Labs to cut the cost of the phone by 40% only 4 months after launch.

Despite the slow start, it remains a legitimate catalyst impacting how crypto-specific mobile apps are used and the development of mobile dApps via the Solana Mobile SDK, which other mobile providers could use.

Number of Saga Genesis Mints (Source: Blockworks via Flipside Crypto)

Number of Saga Genesis Mints (Source: Blockworks via Flipside Crypto)

Yet To Translate To OnChain Activity

The final puzzle piece is onchain activity, which has yet to return despite this year’s positive advances

The Bad

Despite improved network performance and a few notable protocols migrating to Solana, onchain activity has yet to benefit materially.

- Number of active addresses (7DMA): Remains near all-time lows of 238K.

- The value moved onchain: Plummeted from a peak of $200B in 2021 to only $2B in September.

Mixed

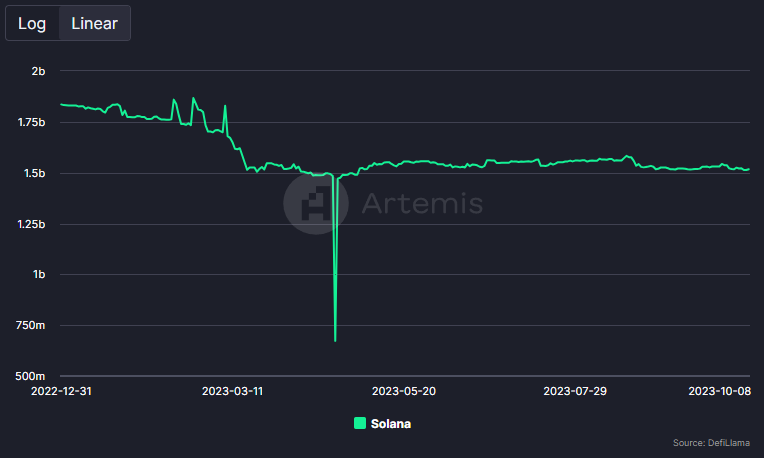

- Total value locked (TVL) remains near all-time lows, down 97% from its peak. However, it has almost doubled to 30.95M SOL this year.

- Non-vote transactions: A superior reflection of true network activity, trends lower, hitting 12-month lows. Overall transaction count has also come down from a peak of ~26M in April 2023 to ~15.4M in September 2023.

The Good

- Not just Solana: The rest of the cryptocurrency industry experienced significant drawdowns on onchain activity.

- Stablecoin volume: Stablecoin volumes have remained consistent at ~$1.5B—indicating confidence to keep sizeable value on the network.

Related posts

Invest in Crypto with Confidence

Trusted by over 25,000+ Aussie investors everyday. Join our growing community now.

Sign up Today